Spain: Increase debt by 5% to increase GDP by 2.5% (with issued debt already at 137% of GDP)

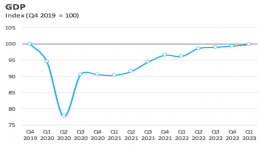

Miguel Navascués| In 2023 the net debt issuance of the Kingdom of Spain was €72,878 m, 5% of GDP 2022. GDP grew by 2.5% in 2023 but with inflation it increases nominally more (€115,000 m) and the ratio falls to 109% of GDP. In reality, however, the debt issued is much higher, at 137% of GDP. Because the ‘official’ debt is 109.8% of GDP. But this figure is arrived at…