Deflation doesn’t benefit production

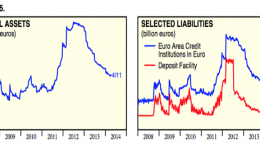

MADRID | By Luis Arroyo | There was a deflation period in Europe at the peak of the crisis in 2008-2010. Demand policies all around the world erased it and prices increased to 3% annual rate. Then, the resulting austerity policies brought us back to deflation.