The Continued Collapse Of Globalisation

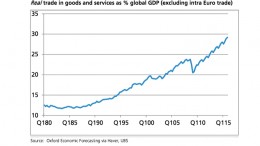

UBS | Global trade in goods and services has risen to a record share of the world economy in real terms. In nominal terms it has stagnated – which basically tells us that the price of traded goods and services is falling relative to the price of non-traded goods and services. Hardly surprising given where oil is.