Mobiles vs Branches: The future for EM banks distribution

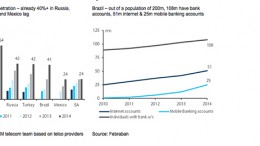

LONDON | May 30, 2015 | Cristina Marzea (CFA) | All the buzz these days is about digital banking: will banks lose business to disruptive entrants, or will they fight back and embark on a massive digital revolution which will see the branch concept become obsolete. Not all EMs are the same – this refers to levels of bancarisation, credit penetration, technology and mobile adoption, as well as the competitive banking landscape that shapes where each banking market is in the technology cycle.