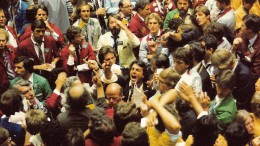

Markets run wild

MADRID | By JP Marín Arrese | Stock markets all over the world are plummeting while bond yields have regressed to fresh lows, as investors grow increasingly worried about growth prospects. Signs the US economy might be slowing down, coupled with the Eurozone plight, paints a gloomy scenario. Yet, the utter lack of direction in policies across the Atlantic stands as the most worrying concern.