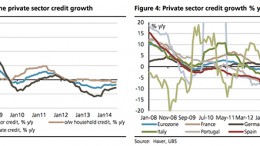

Euro’s depreciation gives Draghi a respite

MADRID | By Francisco López | The ECB’s measures since June have been oriented to fight the ghost of deflation, increasing the Eurozone’s economic activity and, in an indirect manner, managing the euro’s depreciation. For the moment Mr Draghi has failed in the first two goals, although he has succeeded in the third one. The euro is plummeting –which is good news.