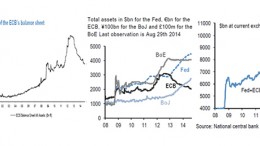

G4 central banks expanded their balance sheets by $4Tr in 4 years

MADRID | The Corner | The size of the ECB’s private asset purchase plan is an enigma. According Mr Draghi, the central lender aims to bring its balance sheet to 2012 levels, that is, from the current €2Tr to €3Tr (March 2012). Some analysts believe he went too far in Jackson Hole and the expansion shall not exceed €450bn (see chart above). Meanwhile, the G4 central lenders have increased their balance sheets in $4Tr since 2010- Only the BoJ continues to expand it at a rate of $650bn/year. And even if the Fed starts unwinding its stimulus program in October, if we add about €450bn annual from the ECB would liquidity would be increased by €1Tr.