ECB takes the reins in a historic move- but where’s the QE?

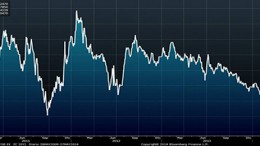

MADRID | By Julia Pastor | In a historic move, the ECB cut the benchmark rate to 0.15 percent from 0.25 percent, and reduced the deposit rate to minus 0.10 percent from zero, becoming the world’s first major central bank to use a negative rate and pushing entities to increase credit lending. Spanish Ibex35 reacted to the news with a 0,8% increase.