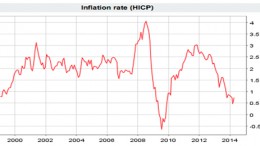

Without a banking union, EMU makes no sense

MADRID | By Julia Pastor | Financial integration that will result from the European banking union will definitely help to reduce systemic risks and simplify an industry that deeply questioned during the crisis. Strengthening capital standards, as established in the Basel III framework, as well rethinking the role of the once ‘too big to fail’ entities are some of the regulatory changes, Governor of the Bank of Spain, Pablo Linde, explained in Madrid on Thursday.