2015 should eventually be better than 2014, but it won’t be a ‘piece of cake’

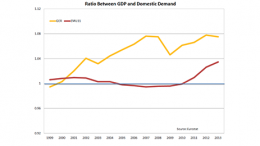

ZURICH | UBS analysts | We review some of the key Eurozone developments of 2014, and look ahead to 2015 and beyond. Eurozone growth has disappointed in 2014, mainly due to Germany, France and Italy. Economic performance over the coming months is likely to remain subdued, given various risk factors, which are likely to weigh on sentiment.