European Investment Banks: Q314 – It’s all about September

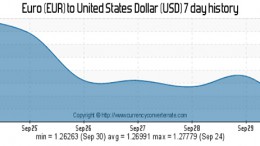

ZURICH | The Corner | UBS analysts explain that in September, volatility started rising in almost all major markets and asset classes. Higher Rates and FX volatility, driven by diverging monetary policies in the US and Europe, typically suggest higher activity and more favourable operating conditions for FICC. Although UBS analyts are still cautious about FICC for structural reasons, some cyclical improvement and potential upgrades in FICC consensus estimates for Q3 2014 are now more likely (UBS tweaks his CS and DBK 2014E EPS forecasts 2% and 3% upwards, respectively). For global IBs, they forecast FICC revenues up 9%, Equities up 3% and IBD up 12% y/y. In the European IB space, they prefer Barclays and SocGen for stock specific reasons.