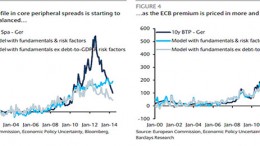

The fair value for Italian and Spanish spreads

LONDON | Cagdas Aksy at Barclays | A model framework, which takes into account economic/fiscal fundamentals and risk aversion factors, indicates a fair value level of about 200bp for 10y Italy and Spain vs Germany. The high debt problem for most peripheral countries is something that will take many years to reverse and the ECB’s commitment through OMT and potential QE can contain these concerns to a large extent, as long as it maintains its credibility. Under this more optimistic scenario, fair value moves down to 90-100bp. After 350-400bp of tightening over the past two years, 10y core periphery spreads are 30-40bp away from stretched levels.