OPEC’s Output ‘Freeze’ Offer Largely An Acknowledgement Of Existing Conditions

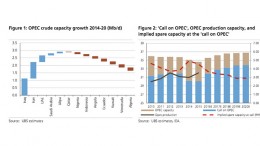

UBS | In this note we present our updated analysis of OPEC production capacity. On a headline basis the numbers are alarming – we expect the group to add close to 1Mb/d to its effective production capacity in 2016 and then a further 0.6Mb/d in 2017. Over the 2015- 20 period we expect total additions of 2.1Mb/d