Risk: Geography trumps Economy

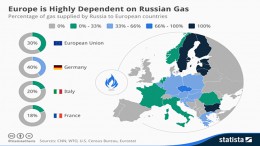

WASHINGTON | By Pablo Pardo | Geopolitics have returned with a vengeance in Europe right when Barack Obama’s economist view of international relations seemed to be on track with the negotiations for the Trans-Pacific Partnership (TPP) and the Trans-Atlantic Trade and Investment Partnership (TTIP). The IMF warns that geopolitical risk is back on stage.