BARCLAYS | Spanish airport operator AENA, the world’s largest by number of passengers, has reported a strong end to 2015 driven by a combination of strong passenger growth, tight control of opex and lower-than-expected financing charges. Aena’s IPO in 2015 was Spain’s biggest since the financial crisis.

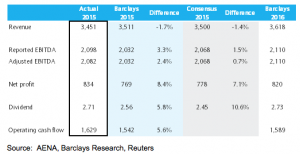

The table below contrasts reported numbers with both our and consensus (Reuters) estimates. This strong P&L performance is supported further by cash flows with operating cash flows c.6% ahead of our estimates and the group has consequently de-levered to 4.5x from 5.6x.

Thanks to the strong beat at the net income level, the 50% dividend payout policy, implies a dividend 6% ahead of our estimates and 10% ahead of consensus. Timing of the dividend payment is not yet known. The proposed dividend represents just 30% of FCF, once the political environment settles and the capital allocation policy decided, there is scope for further shareholder returns.

2016 expectations.

Management shared limited guidance for 2016, in our last published numbers (shown below) we have modeled 5% passenger growth, the agreed -1.9% tariff cut and continued investment in rebates and incentives. We note that the 2015 passenger growth exit rate was in the high single digits, and for January reached 12%. It is also worth bearing in mind that management outlined €34mn in further interest savings that have been secured through variable to fixed conversions and spread reductions.

Regulation – AENA is now in consultation with the airlines and heading towards its submission to the regulator, expected on or before 15 March. This remains the key topic for 2016 with AENA’s initial proposal of flat tariffs. The formal proposal will detail the building blocks behind this proposal, including the assumed passenger growth for the period and the allowed return. We have previously published a note running through the sensitivities, please see link: AENA: Regulation – testing the sensitivities. AENA remains confident that the political backdrop should not impact the timing of regulatory agreements.

AENA – 2015 vs Barclays and consensus