Morgan Stanley | Enel and Endesa (ELE) will present their strategic plan for the next three years at the CMD (November 26 and 27 respectively). The situation, relative to last year, is now quite different, since Enel is no longer listed near our bear case, having been one of the best YTD utilities. For its part Endesa has also done well throughout the year.

We enter positive both CMD and take the opportunity to review the investment thesis:

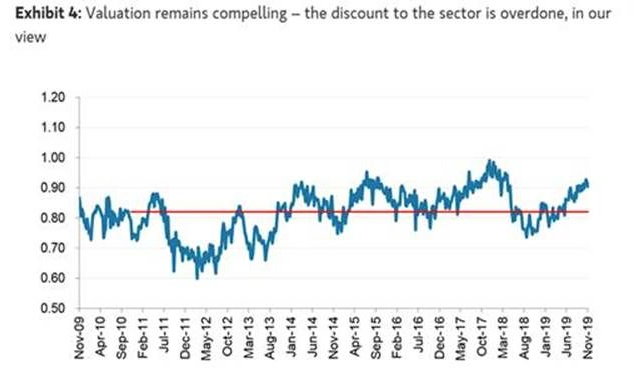

At Enel, we continue to see the discount with the quotation exaggerated against the sector (8-9% PER’20-21), by undervaluing its strong growth profile (growth in EPS CAGR 18′-21 ‘of 10%), as well as the expected new renewables plan, so we continue to maintain the OW.

In Endesa, the stock continues trading with a slight premium vs. sector. Consensus has a very negative vision for guidance 21 ‘, standing 10% below the company’s net profit objective, while our analysts have a somewhat more positive view, although below guidance (6% above .). We reiterate the EW.