It is happy that the last two- month correction offers a buying opportunity as investors have been rather quick to see that the German do-everything-slow-moving juggernaut had actually become a sexy investment proposition with divisions branding using the right words (“digital factory”, “mobility”, building “technologies”). Siemens has essentially gained 50% over the last two years, more than its reference sector whose semi-cyclical credentials have been put in orbit anyway. We see a 13% upside potential and potential for EPS upgrades.

What has changed? Management! Financial performance is no longer an insult.

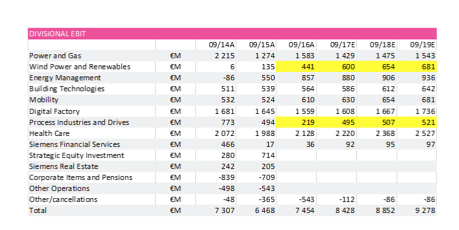

Q2 earnings to March 2017, up 30% on a true EBIT basis reflect a new dynamic. The drivers have been “fast” businesses (Mobility, Processes, Building Tech and Digital Factory) even though the top line is actually not quite convincing with still a weak order intake excluding Germany. The rest of the Eurozone may join sooner than later as the ECB cheap money potion seems to be working after all. Below is a table about divisional contributions to EBIT with the drivers highlighted.

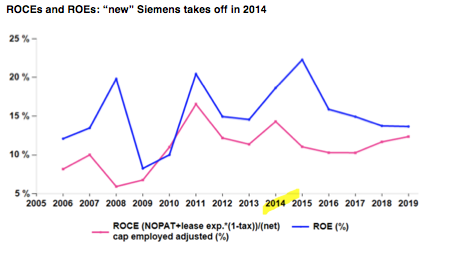

Siemens’ management compensation is based on a mixture of ROCE, EPS levels and individual targets. All such figures can be massaged but not over a long period. The new Siemens that was launched in 2014, with the aim to capture the whole value of digitalisation of the electrification chain, is a combination of exceptional know-how and acquisitions to match its ambitions. Experts at Carax- Alphavalue believe that still, ROCEs are not quite yet flamboyant ss Siemens pays a market price to hop into these digital territories.

In this respect, it does not differ from SAP (see our interesting comparison dated 30/08/2016 that shows that shifting gears at German juggernauts can happen and convincingly so).

It is a fact that chasing digital opportunities in so many industries puts Siemens on a course similar to that of SAP. The last instalment being the acquisition of Mentor Graphics for $4.5bn or nearly 4x sales. The bid for smaller CD-adapco was at 5x sales. By so doing, Siemens is on a collision course with Dassault Systèmes (Reduce, France) on PLM offers and above all pays top money and depresses its ROCEs.

Learning from minorities?

An interesting twist to the “we can do anything on our own” industrial history of Siemens is that it sees a benefit in sharing. The glaring example is the merger of Gamesa with Siemens Wind Power and leaving the new business both listed and Spanish-driven. A degree of this good sense was already visible with the management of acquired Dresser Rand keeping a leading position in the Power and Gas business. Just as well the confidence in getting more from an open-minded attitude about capital control was established with the listing of Osram to be likely followed by that of the Health Care business (rechristened Healthineers) the current single most valuable asset of Siemens.In analysts’ opinion:

It will not hurt to create some market pressure on this division’s management as the paradigm shift from product business to solution-oriented systems for the health care industry is still not visible when analysing the financial results.

Right course, right intentions, how about valuation?

Finally, Carax-Alphavalue sees a 13% upside potential but we are better off to support this valuation case if investors do not all of a sudden look at Siemens as a holding company.They conlcude that:

If and when Healthineers gets listed, about a third of Siemens’ asset base will be with a daily valuation. On that front, we do not see much upside (after allowing for underfunded pensions) but we may be too cautious on individual businesses valuations. After all, if the “Digital Factory” is more digital than factory, it may be worth 50% than the 14x EBIT that we ascribed to it currently.

On other metrics, DCF and peers, Siemens’ valuation is all green lights as analysts are confident about delivery.

*Image: Flickr/ Siemens