BNP Paribas’ brokerage house Cortal Consors warned about market distrust and the contagion effect over the region after the Argentine government made the announcement this week of the nationalisation of Repsol’s subsidiary YPF. In Friday’s strategy note to investors, Cortal Consors analysts said market participants fear other countries in the Latin-America area could follow the aggressive policies of Argentina’s president Cristina Kirchner, who is since her re-election trying to stop capital outflows from the country.

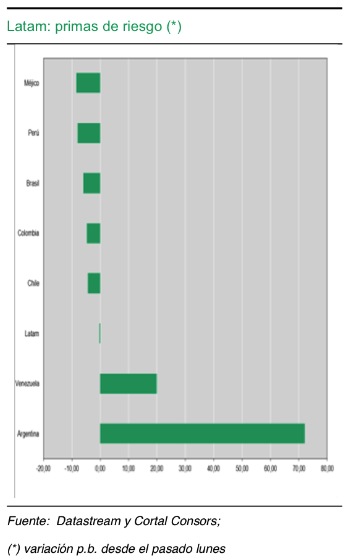

But is Kirchner succeeding in her pursuit? Not at all. Risk premiums have since last Monday dramatically increased for Argentina, reflecting investors’ rejection of the YPF move. In fact, figures have improved for Brazil, Mexico, Ecuador, Colombia and Chile, while worsening for Venezuela and Argentina.

Cortal Consors experts added that both countries

“suffer from sizeable imbalances, high inflation and, in Argentina, difficulties to access finance. Furthermore, Argentina is one of the few countries in the LatAm zone that saw foreign direct investment falling in the second half of 2011.”

Cristina es una vendida a los intereses de los grupos financieros y judìos y es pura pantalla,,,hay gato encerrado, asì que a otro con ese cuento chino.