Takeaways from the EBA exercise

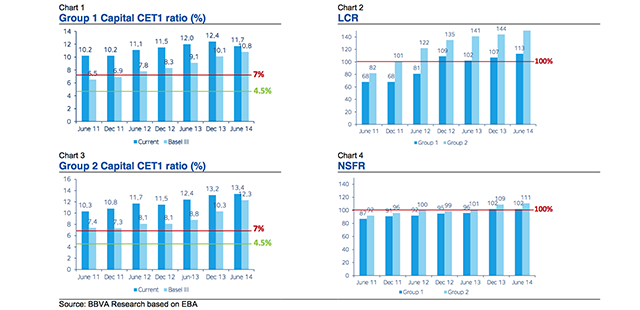

Capital: Enhancing fully loaded capital base continues. There is an increase in Basel III fully loaded ratios, both since the beginning of the monitoring exercise (data as of Jun’11) and from the last report (data as of Dec’13), due to a higher tap to capital markets. Fully loaded capital is lower that current capital base as a consequence of a stricter capital definition and of a lesser extent by RWAs increasing. CET1 ratio under current regulation is lower in this exercise for G1 because of the first application of CRR / CRD IV rules, which entails stricter methodology compared with Dec’13. Same reason applies to the slowdown in the CET1 ratio increase for G2. Nevertheless, the capital shortfall has dramatically dropped to EUR2.8bn versus EUR11.5bn estimated in the previous report for G1. In that vein, more and more entities (over 90%) are above 7% CET1 in the current situation.

Liquidity: Liquidity ratios keep improving. As shown in Chart 3 the average LCR has improved both for G1 and G2 since previous publications. This improvement is mainly driven by structural adjustments (increase in stock of liquid assets, reduction in net cash outflows). The increase in HQLA is presented by Level 1 assets (top tier liquid assets), with over 80% of HQLA constituting this kind of assets. Also, within Level 1 assets, a shift from cash and central banks reserves towards sovereign bonds has been observed. Over 75% of banks are already above the 100% requirement, resulting in an overall LCR shortfall of EUR114.6bn. NSFR remains almost unchanged with bias to improvement (revision of Basel Committee Standard).

Leverage: Banks have significantly increased their ratios since previous exercises, partly due to the recalibration of the ratio in January 2014. However, this increase has been lower than the ones in previous publications because of the application of the CRR rules for capital definition. The shortfall for G1 is EUR2.4bn and EUR3.7bn for G2.

Be the first to comment on "EBA on Basel III Monitoring Exercise"