This would be lower than in March as the three banking systems that so far have borrowed more according to our estimates (France, Italy and Spain) could borrow less, given their past large TLTRO take-up. However, risks are skewed to the upside.

Economic activity is improving, supported by cheap oil, weak currency, and stronger consumer and investor confidence. The most recent monetary aggregate and bank lending data for April 2015 showed a slight growth in loans to the real economy. We expect lending dynamics to improve further, but the recovery will not be V-shaped as deleveraging dynamics are still occurring.

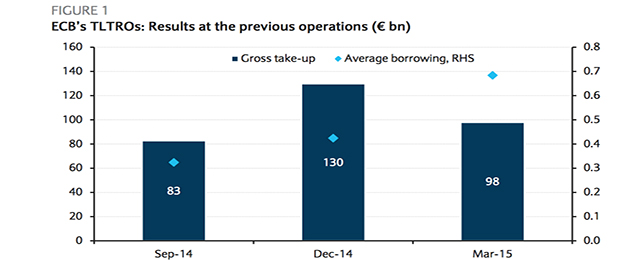

We continue to believe that TLTRO remains attractive even in the context of QE. In March, the total TLTRO take-up was about €100bn, while since the beginning of QE, banks have sold a tiny fraction of their government bonds.

The PSPP is an asset swap programme that replaces an asset (government bonds) with another asset (central bank reserve). Both of them are LCR eligible, but not perfect substitutes as bonds can be used in the repo market and could become “precious” if there is a collateral shortage due to QE purchases.

In contrast, TLTROs provide banks with a liability (a TLTRO loan) which creates the potential for balance sheet expansion, possibly including an increase in lending to the real economy. Hence, PSPP will not inhibit banks from drawing liquidity at the TLTRO operations, in our view.

We estimate that the June TLTRO, together with the weekly QE purchases, should bring the liquidity surplus to €350-400bn by the end of June. This would fuel further downward pressure on the Eonia fixing and 3m Euribor.

Be the first to comment on "The ECB’s TLTRO 4.0: Feeding the rising loans demand"