We attribute this to credit markets already pricing in European QE. While equity markets could continue to outperform in a rally, we believe that option markets in credit and equity offer compelling relative-value trades for a sell-off.

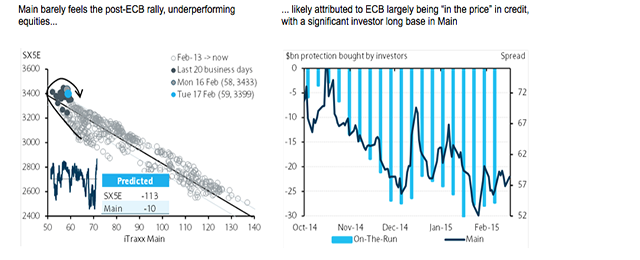

Since October 2014 a persistent theme has been observed in credit at a macro level: iTraxx Main (the most watched CDS index in Europe) has traded tight vs SX5E compared to historical levels. Thanks to the sharp rally in equities post ECB announcements, this relationship has shifted dramatically (Figure 1, above left). As recently as 17 January, Main was trading 9bp too tight on a historical basis; by Thursday, 17 February, Main was trading 10bp too wide. Essentially, within two months, the SX5E-Main relationship has swung from being at the 2y historical extremes at one end to the historical extreme at the other end.

We believe this happened in credit because investors were already pricing in ECB QE, having sold significant amounts of protection from October to December (Figure 2, above right).

To an outsider, the sharp increase in European equities, combined with the sharp drop in the EUR, has a distinct feel of the “Japanese QE trade” being put on in Europe: long the equity, short the currency.

*Graph source: DTCC, Markit, Barclays Research.

Be the first to comment on "European credit vs equity relative value: what a difference a month makes"