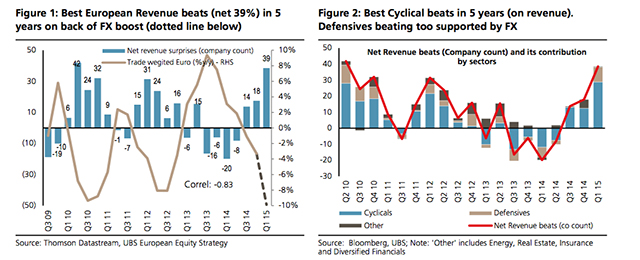

Revenue beats are not only twice as good as last quarter (Q4) but also the highest in 5 years – at 39% – as below. EPS net beats have also jumped, from basically zero in Q4 to 16%. Currency boost: the trade- weighted Euro provides a 10% tailwind, the biggest in 5 years (vs 3% in Q4), fig 1.

Cyclicals carry the baton: responsible for 75% of Revenue beat. This is no blip…

In Q3 & Q4 of 2014 cyclical revenues had a net 12% beat. This quarter it was more than double – at 29% (fig 2). What’s more, analysts didn’t lower the bar before results season – quite the contrary! Cyclicals saw upgrades from Oct 2014 up to the start of the reporting season (pg 7); Banks were in 3rd top spot on Revenues beats. BNP Paribas had a big beat and highest RoTE (11.7%) since 2011. Renault and BIC also beat on stronger growth in Europe. But Vinci found France difficult. Energy companies beat (but as expected on profits rather than revenues).

Yet there is scepticism: 4 reasonable concerns

1) It is hard to believe in forecast earnings after 8 (out of 9) years of disappointment. The cycle failed to reignite post 2007. But, it has returned and catch up is due: earnings are still in slowest lane for 50 years and and at record gap to US; 2) What happens to exports with a bounce back to EUR/USD of 1.14? This recovery is consumption-based rather than export driven (unlike 03-07); 3) The oil price is up c. 50% from its low? Eurozone still gets a solid GDP boost and a rise supports market earnings. 4) Isn’t the cyclical trade over? Valuations are still at a discount and performance has lagged.

US: over 90% reported: below average results ‘and’ weak guidance

458 companies (93.0% of S&P) have reported. Even with the bar lowered, a 68% beat on EPS is still below the average of 71%. While 37% have beat on revenues, this too is vs an average of 50%. Guidance is poor: 63 out of 86 companies are guiding below consensus estimate.

Be the first to comment on "European equities: Q1 revenue & cyclical beats best in 5 years!"