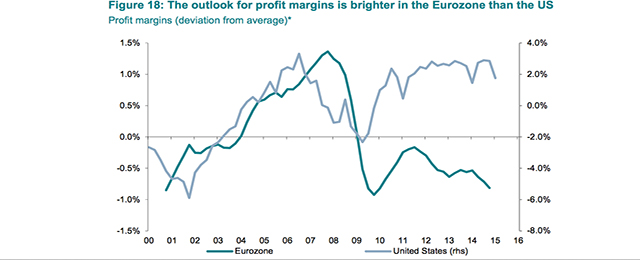

In the Eurozone, profit margins should rise in the coming years as labour markets are still relatively weak. The fall of the euro and the decline in oil prices will also provide another temporary support this year. Looking further ahead, there is much more upside in France and Italy than in Germany, where domestic inflation should curb corporate profitability.

Low corporate pricing power for longer

The pricing power of corporates remains low at a global level. The main reason is that global excess capacity is sizeable. Our estimate of the global capacity utilisation rate is currently below its historical average and has been declining slightly over the past two years. The recent downtrend is entirely due to the decline of producer prices in China.

As global growth remains moderate, the absorption of excess capacity will be slow. In addition, the pickup in inflation is likely to be late in this cycle, because nominal rigidity may have prevented companies from cutting costs as much as they would have liked. The most recent IMF forecasts are in line with this view, as GDP price inflation is expected to remain flat next year in advanced economies despite economic improvements.

That said, the cyclical position varies a lot between countries. Several countries have almost closed their output gaps and could soon experience a cyclical rebound in domestic inflation. This is the case for the US and Japan. In developed Europe, only Germany and Sweden are in this situation; the UK is not too far behind.

Profit margins should, however, rise in the Eurozone

Paradoxically, low pricing power is not equally bad for all corporates (of course any corporate would like to have high headline growth and hence strong pricing power). For the Eurozone as a whole, profit margins should rise in the coming years despite weak pricing power.

Be the first to comment on "EZ profit margins to outperform the US"