LONDON | The direct costs of a Greek default and exit would appear controllable after all, analysts at Barclays Capital noted in a report to investors on Friday. But for all the sense markets are supposed to instil into State finances and economic policies, as their champions tirelessly tell everybody, emotion accounts for an awful lot.

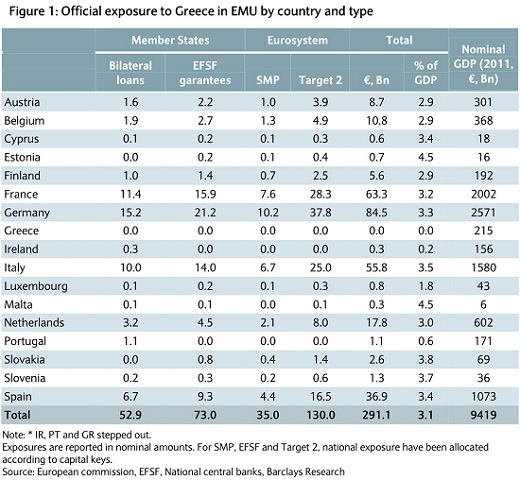

Let's say, for instance, that yes-all right, Greece's new government would be formed by euro sceptics who understand the right of not paying back certain debts as inherent to the nation's ancient conception of democracy. In this case scenario, the direct exposure to Greece for euro area countries is non-negligible and yet, it shouldn't trigger any Eurogeddon. By Barclays' calculations, the figure falls somewhere near

“€290 billion of exposure to the Greek government, with roughly one third of this amount in exposure to private-sector entities.

“This appears to be manageable even if Greece were to default and recovery rates were low. In any event, some credit losses from a restructuring of Greek liabilities to the rest of the euro zone will likely be realised even if Greece remains part of the monetary union.”

The exposure to the Greek public sector that euro zone governments have accumulated now amounts to roughly 3% of GDP.

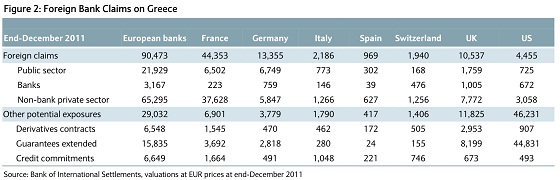

The eurozone’s exposure to the Greek private sector is substantially smaller than its exposure to the Greek government. Much of this is in the form of bank

claims (€70 billion). But even in France, the most heavily exposed of the larger European banking systems (€34 billion), the exposure does not seem large enough to pose a systemic threat.

In short, Barclays experts say,

“the direct losses from a Greek exit seem unlikely to destabilise the rest of the euro zone, even if they lead to widespread restructuring of claims on the Greek private sector.”

So what would the problem be? The so-called contagion effect. That is, what investors' guts tell them. It is all about unknown known.

“First, abandoning the euro and re-denominating contracts into a currency that does not yet exist is much more complex than a public-sector debt restructuring, for which precedents abound. It is not only more complex but also more unpredictable in its consequences, many of which will be indirect.

“A Greek exit will likely result in private, as well as public defaults, and the corresponding losses may be very difficult to predict. It also has potentially greater negative value as a precedent. Government debt restructurings happen all the time, but even partial breakup of a monetary union is very rare. If Greek becomes the first departure from the eurozone, it will be hard to avoid the question ‘who’s next’?”

The names are written on the wall, already. And the list will go on growing.