…the CDS index liquidity advantage.

Liquidity conditions in the high yield cash bond market are stable. However, high yield CDS indices continue to offer higher liquidity in all market conditions. Investors wary of the liquidity of the high yield cash bond market should switch to CDS indices to benefit from the liquidity advantage of CDS indices.

Liquidity conditions in the high yield cash bond market are stable. Testimony of that was the resilience of the high yield market in July/August 2014 in comparison to May/June 2013. In May/June 2013, the US high yield bond market decreased by -5.15% and experienced outflows of USD -12.4 bn. In July/August this year, outflows were larger, USD -15.6 bn, but the US high yield market only decreased by -1.96%[1].

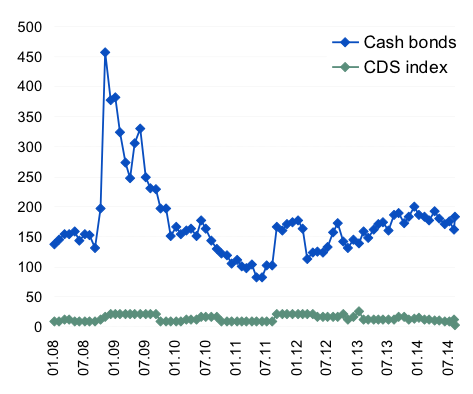

High yield CDS indices continue to offer better liquidity conditions than high yield cash bonds as illustrated by the very low and very stable bid-offer spreads of the high yield CDS indices in comparison to the high yield cash bond market, even during the credit crisis in 2007/2008 or the euro sovereign crisis in 2011 (chart 1).

The tight bid-offer spreads of high yield CDS indices materialise the much better liquidity of the indices. In 2008, this liquidity advantage generated a capital buffer and outperformance for CDS indices relative to the cash bond market of +18.8%[1].

Parameter #2: Rate sensitivity.

High yield would be challenged by a rate hike…

…the CDS index interest rate advantage.

Deteriorating macroeconomic conditions, not the Federal Reserve tightening cycles lead to wider high yield spreads. However, high yield cash bonds are not immune to rising rates as they are structurally exposed to the interest rate risk. On the contrary, high yield CDS indices are not at risk: they have zero exposure to interest rates.

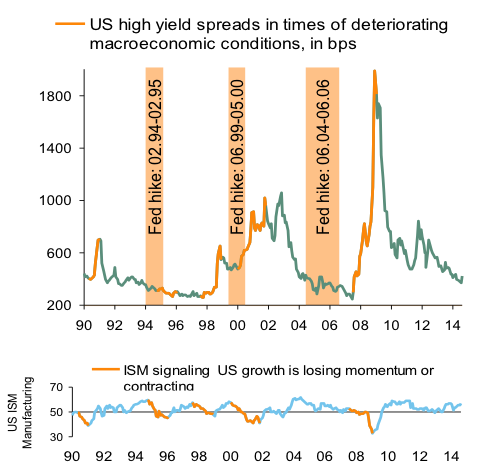

Looking at how US high yield spreads evolved since the 90’s and going through three Federal Reserve rate hike cycles, spreads only widened in one rate hike cycle out of three, and not when the Federal Reserve initiated its rate hike cycle, as illustrated in chart 2, but when macroeconomic conditions started deteriorating. This was because the Federal Reserve was running after inflation and the tightening to 6.5% engineered a growth slowdown: a very different situation from today.

[1] Source: UBP, JP Morgan, BofA Merrill Lynch indices. Global high yield: a 67% exposure to the US and a 33% exposure to Europe. CDS strategy with the same modified duration as the bond market (3.7 years). Peak-to-valley monthly drawdown. Data gross of fees

The global high yield market exhibits an average interest rate exposure of 4.5 years since 2004. Thus, the asset class is structurally sensitive to changes in interest rates and would be impacted by rising interest rates when the Federal Reserve starts normalising its monetary policy.

Parameter #3: Fundamentals & Valuation.

High yield valuation and fundamentals would be getting exuberant…

…the CDS index valuation advantage.

Fundamentals are not deteriorating and corporate profits remain healthy, supported by steady growth, very cautious central banks and low default rates. The valuation of high yield remains all the more attractive as CDS indices offer a yield pick-up vs. high yield bonds.

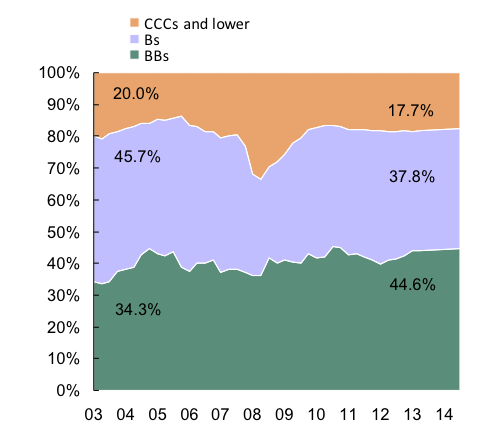

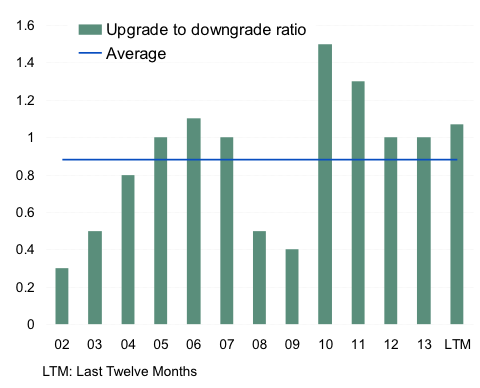

Fundamentals are not deteriorating as illustrated by i) the rating mix of the high yield market which shows that the portion of BBs are increasing (chart 4) and ii) the upgrade-downgrade ratio which stands above its historical average (chart 5).

In addition, in a context of relatively low growth since 2009 and lower growth in the foreseeable future, as underscored by Yellens’s comments, companies are overall more financially disciplined, supporting low default rates expectations.

Chart 4: Rating breakdown of the US high yield market since 2003 (face value)

In this context, default rates are set to stay low, 2% this year and next year and high yield CDS indices continue to look attractive as they discount a 6.0% default rate[1].

In all, high yield remains appealing, specifically via high yield CDS indices which combine a liquidity advantage, an interest rate advantage (no exposure) and a valuation advantage.

Be the first to comment on "The high yield investment case revisited"