Financial markets in the euro zone are entering a calm stage at the end of the year. Afi analysts in Madrid said in a note to investors that, apart from falls in risk premiums spreads between peripheral and core euro countries, monetary aggregates prove the bank deposit base has been strengthened and issuing activity in the debt sector has also increased.

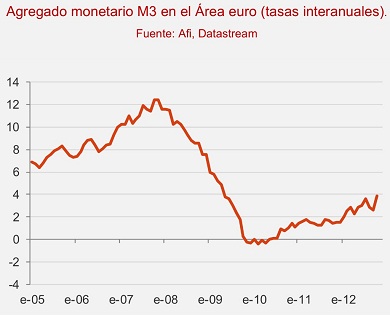

M3–a measure that includes cash in circulation, and short-term and long-term bank deposits, money market funds–grew at a year on year rate of 4 percent in October.

Experts added that lending to the private sector has not yet benefited from this positive development, though, as it is still under contraction. Core euro zone is not escaping the trouble, either. In fact, credit to businesses and corporations has slowed down in Germany, while it has lost a year on year 1.1 percent in France.

Be the first to comment on "Is the euro zone stabilising?"