Yields on Italian 10-year bonds will keep under tension after the latest economic data brought investors a negative surprise. The country’s GDP suffered a further contraction of -2.5 percent year on year in the second quarter of 2012: the previous figure had been -1.4 percent and market expectations had pointed at -2.3 percent.

Industrial production played a major role, with a -7.9 percent year on year rate that was 2.4 percentage points worse than in the first quarter of the year. Investment in capital goods dropped, too, by -7.6 percent.

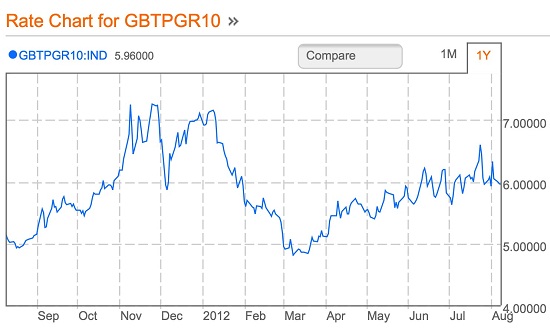

So what’s holding yields over the 6 percent zone? (8 percent is the common denominator of the three euro country members that have had to enter into a bailout programme). For a change in the euro scenario, it could be the politics. Italy’s prime minister Mario Monti just won a parliamentary confidence vote, which should give him a speedy ticket to introduce more austerity measures.

Budget cuts this year will be of some moderated €4.5 billion, but in 2013 they are supposed to amount to €10.9 billion and €11.7 billion in 2014. In 2013, the Italian government is also set to raise VAT rates. The markets are watching.

Be the first to comment on "Italy’s GDP worse than forecast"