The Spanish investment website Consenso del Mercado published on Friday this revealing note and table from Morgan Stanley about the ECB loans.

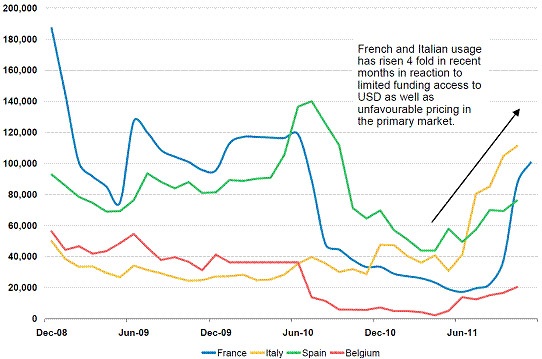

“The deterioration of the euro zone crisis makes very difficult the necessary deleveraging process, which is estimated at €1.5 to 2.5tr during the next 18-24 months. The ECB lendings have reached two-year record highs with French and Italian banks being the ones that increased their demand the most.

“Limited access to USD financing and higher bond issue costs are strangling the capacity of banks to deleverage. We see a real risk in the securitised assets (0.5Tr), the real state sector, and especially in the Eastern and Southern Europe countries. We maintain our recommendation for Sberbank, Barclays, DnB Nor, BNP, KBC and Deutsche Bank.”

Be the first to comment on "Morgan Stanley: “French, Italian banks lead ECB lending demand”"