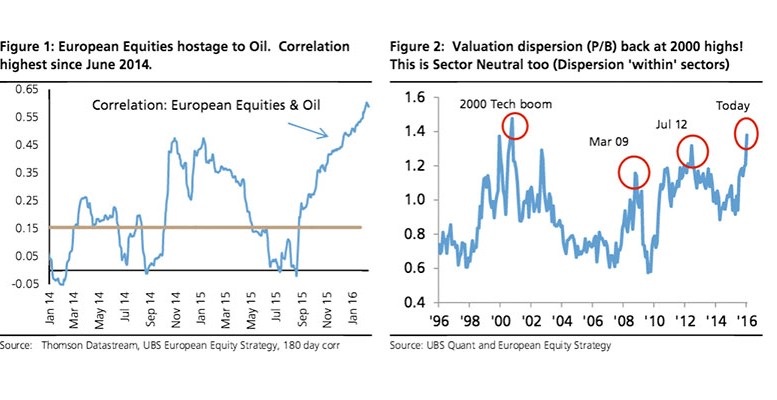

UBS | The distaste for value is back to the ‘growth love – in’ high of 2000. The valuation stretch between winners & losers (within a sector) has only been this high 4 times since 2000: 1) end of Tech bubble; 2) Mar 03 recession; 3) Mar 09 Financial crisis; and 4) Jul 12 ‘euro panic’. To get into the Red Circle investors have to feel pretty ill about the future. If we look 12 months beyond these peak gaps, the performance of Value was up on average 20% (higher post 2 000!) and for Quality down 21%. In our view, unless we have another big crisis, it would be dangerous to be positioned against this.

Oil is the culprit: Correlation to Value, European Equities & Banks is extreme

We link Oil & Value in this note because oil price seems to be the key driver of the value gap. The correlation between Oil and ‘sector neutral’ Value has moved with Oil and is near a 2 year high. The link to European Equities (fig 1) and Banks (fig 7) is extreme.

3 perceived impacts of collapsing Oil

We think worries are overdone 1. Financial contagion? European Energy dividend pay – out ratio triples from 2007 but we’ve been here before, in 1998. Plus, if we look at European banks exposure to Energy it is less than 3% of loans (fig 17). 2. Hit to earnin gs? Energy & Mining’s share of profits has fallen by 60% and is less potent. 3. Global Growth? We think the US shock is behind us (page 11) and take comfort that the EM growth premium to DM has unwound back to 2000 levels (pg 14). Plus 75% of EM countries are oil importers.

Oil – Sensitive stocks that fall into Cheap & Expensive camps in our value screen

UBS analysts flag oil sensitive stocks. We select 1) stocks hurt by falling oil that underperformed and are cheap via our intra – sector value screen, such a s: Weir, E.ON, Engie and Lanxess; and 2) stocks that have benefited from falling oil that outperformed and are expensive such as: Frutarom, Kingspan, Symrise, Ems – Chemi and Givaudan.