CaraxAlphavalue | We held the view a year ago that 2016 would be difficult. It turned out to be wrong from summer 2016. Still, we repeatedly mentioned that the 2016 earnings delivery would not be as strong as anticipated from a recovery year after a disastrous 2015. 2016 earnings ambitions started 2016 with a +12% hope. By early 2017, we are down to 7.5% on AlphaValue’s coverage (469 stocks with a combined market cap of about €9tn).

As downgrades have not been matched by lower prices (Stoxx600 including dividends up 2% yoy), the average P/E for 2016 is 16.6x and the opening one for 2017 is 15.5x. The median 2017 P/E is at 17x. This implies considerable confidence. We are not sure that this can be warranted by earnings developments.

Earnings still not shining

There is indeed quite a gap in 2017 earnings growth expectations between average (+18.8%) and median (+9.3%). The average is (as usual at this time of the year) embarking the lost expectations of the previous year (say about 4% have been “passed” between 2016 and 2017). The median is a duller story as usual.

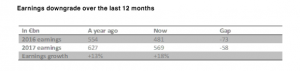

The following table shows the extent of downgrades over the last 12 months and how less in €bn eventually becomes more in % terms. The big divide between those who buy the actual amounts and those who buy the rate of change is bound to continue. The handful of observers who pays attention to the second derivative (revisions) will not make a difference. Earnings downgrade over the last 12 months.

About half of the earnings downgrades over the last 12 months is due to Banks. Much current market hopes is hinging on the fact that such downgrades are now behind. So that Banks are expected to gain 36% in 2017. Who cares about the fact that the Banks’ 2017 earnings promise at €94bn is actually below what was expected a year ago for 2016 (€107bn)?

Confidence at a high point indeed

Earnings growth quality being still a challenge, sentiment is what drives markets. Our preferred tool to gauge this dimension (momentum analytics) is showing continued strengths as sellers have essentially capitulated (red line in following bottom chart). A two-year perspective of momentum dynamics would suggest that the bout of positive sentiment can last and embark up to 75% of the universe from a current 60%.

This may mean that the 2017 market P/E may be above 16x before a degree of technical correction sets in. We doubt that this is sustainable.