AlphaValue | In a very short time, several key threats for investors have come together, like the trade war between China and the US, the US fiscal deficit, a weak dollar and China’s recent inclination towards dictatorship. Not to mention Italy’s political instability. All those factors have combined to paint a picture which makes Alphavalue’s anlaysts wonder if we should start to bet on defensive stocks. “The contrast with the situation just one month ago really grabs the attention. At that time, the market was betting strongly on cyclical stocks, with the acceleration in “the cyclical recovery” being the fashionable term,”, they explain.

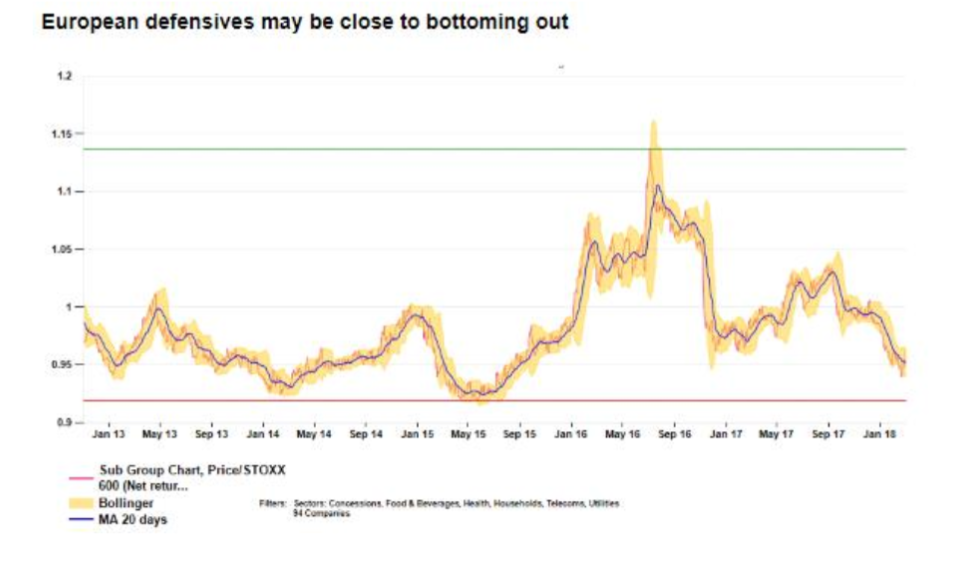

The following table shows the relative performance of the defensive sectors, in other words, Health (ex Pharma, due to its weighting), Public Services, Concessions, Telecommunications, Food and Beverages and Household Products. The following graphic is weighted and covers 94 shares in total. According to Alphavalue:

“What can be deduced from the graphic is that, taking into account the last five years, defensive stocks only had a brief moment of glory in 2016 when fears with regard to the banks turned into fears about Brexit and then even more so about Trump.” Although the red line, which indicates the relative return, shows some recovery from last month, it still has a considerable way to go.

There are as many definitions of what a defensive stock is as there are aspiring strategists (without mentioning the fact that the progress in technology is breaking with the sector’s standards). But the experts at the house are offering here the essential valuation data which they have used for the sectors included in our choice for today. This list covers 94 shares, with a market capital of 2.2 trillion euros, representing approximately 25% of Alphavalue total coverage.

The combined upward potential is approximately 16% on a six month horizon; in other words, approximately 500 basis points more than the average of AlphaValue’s total universe. EPS growth is the average for the market for 2018 (and also for 2019, although it is not shown in the table). We believe this is fairly satisfactory, taking into account the limited growth which is normally expected from these companies. The dividend issue has been a sad story over the last decade for both Telecoms and Utilities. That said, it’s hoped that things will improve from now on, with returns which should trend towards the market average.