In 2011, the then governor Jean-Claude Trichet turned the European Central Bank into a weapon of euro destruction. He increased interest rates twice, first in April and again in July of that year.

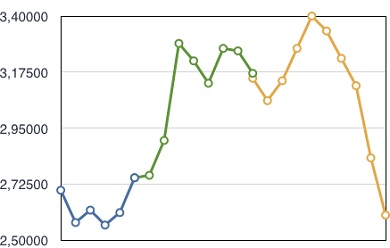

These decisions unleashed weaves of risk aversion that reached the US shores, too. The blue tranche in the monthly data of the chart reflects the spike in risk premium experienced in May, which grew higher until July and August of 2011, the two hills. The third hill was caused in mid 2012 and its a consequence of what Trichet had started and that Mario Draghi, our current central banker, could not halt.

It was back then when the Spanish risk premium began its upward trend. Trichet was responsible for Spanish and Italian credit costs getting out of hand. In November, Trichet had to rectify but it was late, and Draghi had to go further in December.

The ECB acted against all prudential judgements, and upset the markets in the US and Europe to such an extent that in June this year Draghi, after one year in his job, announced the Outright Market Transaction programme to impede a more dangerous economic deterioration.

Draghi has successfully cut down market pressures, with the US Federal Reserve’s inestimable help and the Bank of Japan’s. Risk aversion has softened and investors aren’t as scared as they were. It is, nevertheless, a simple plaster rather than a long-lasting solution. The relative calm we live in now is precarious.

Any accident, like the so-called ‘fiscal cliff’–tax relieves ending suddenly in the US and depressing domestic demand–or a failure in Europe to deal with the Spanish bailout, may drag us all down once more.

Because the US and the EU are together in this mess. Do you remember those three hills I spoke about above? There you have them: the graph shows the spread between corporate bonds and US Treasury bonds, which is used as indicator of investor risk aversion. Coincidences. Not.

Be the first to comment on "Why Draghi must free the ECB from its Trichet past"