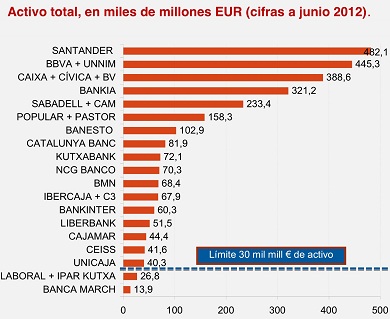

Once the European Council approves its legal framework, the European Central Bank will become the supervisor of state-owned banks and those whose asset sheet surpasses either the benchmark of €30 billion or their country’s 20 percent of GDP. Governor Mario Draghi will be the watchdog for some 200 financial and credit entities.

In Spain, that means that over 80 percent of all deposit banking institutions–six of them systemic–will be inspected by the ECB from 2014. Practically all former savings banks or cajas will fall under the central bank’s scrutiny, with only a few cooperative entities left aside as their small average size is €2 billion.

Analysts at Bankia Bolsa said in an investor note on Friday that “even though the scope of the single supervisor mechanism has been limited by the German government, markets have welcomed the move and peripheral countries like Spain continue enjoying credit access.” Experts admitted that the option favoured by Madrid, of direct refinancing for troubled banks, is unlikely to be agreed upon.

BNP Paribas highlighted, too, that Spain has paid less in its latest sovereign debt auctions, which have been covered by more-than-double demand rate.

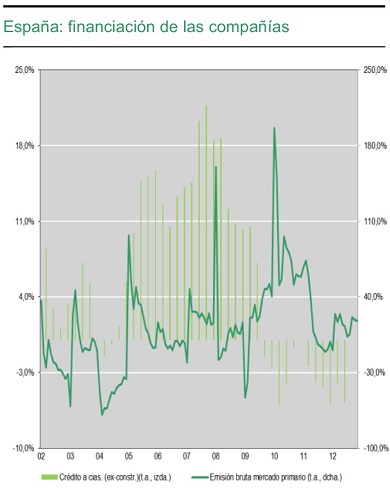

Via its broker Cortal Consors, the French bank said to its clients that the Spanish risk premium has fallen by 150 basis points “as expectations increase of an official request for a bailout. This has allowed Spain’s large companies to obtain financing on primary markets.” Since January 2011, corporate debt issuing had been flat, but this changed in September when risk spreads began to tighten and costs dropped.

Be the first to comment on "The Spanish banks under single European supervision"