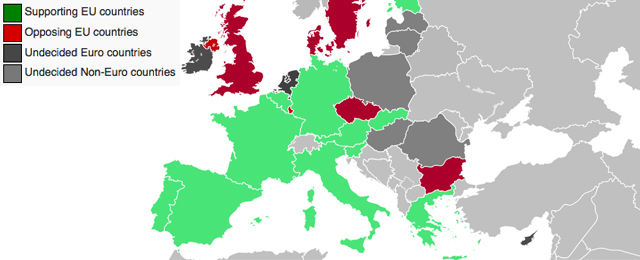

Ecofin’s Tuesday meeting preliminarily agreed to introduce a new tax on financial transactions by 2016. Spain, Germany, France, Italy, and seven more countries supported the initiative. Analysts from ACF expect a moderate impact on Spanish listed stock exchange operator BME and a hit on equity trading volume by 10%.

Implementation is scheduled in stages, firstly shares and some derivative instruments, to assess economic impact. The definitive outline of the tax with feasible solutions should be ready by the end of this year. It’s no surprise that the tax is raising an intense debate in finance industry heavyweight Britain:

“Judges in Luxembourg seem no longer willing to uphold the integrity of the EU single market,” says The Daily Telegraph’s Ambrose Evans-Pritchard, who considers the free movement of capital within the EU, one of the Four Freedoms underpinning the european project, would be breached. “The ECJ has come close to destroying the last good reason for Britain to stay in the European Union.”

Anders Borg, Sweden’s finance minister, stated the process was so unsatisfactory that he was minded to join the UK in mounting a legal challenge.

“What we have is a political commitment to put forward a sensible prudent and cautious tax on financial transactions,” Spain’s finance minister, Luis de Guindos, weighed in.

According to Barclays Pan-European Equity expert, Alberto Vigil-Escalera, markets take for granted Mario Draghi will remain sitting on his hands. The ECB won’t take any measure and will set off a prospective interest rate reduction. However, the analyst doubts whether such action would make a difference and Mr Draghi needs to see blood in the market to give a robust answer.

European PMI and stock markets touching maximums and companies are expected to yield double-digit profits, so we are from seeing any flood. Besides, Vigil-Escalera is uncertaing about a interest rate drop stopping euro appreciation.

Spanish energy company Abengoa bought 25% of Chinese leader in the treatment of waste water Green Tech. Abengoa strengthes its position in the water market after carrying out projects in this sector in China like the Qingdao plant.

Moody’s considers downgrading Deutsche Bank rating due to 34% drop in results and steady difficult to accomplish business plan. Santander points out DB is one of the most undercapitalised European entities together with UniCredit, both in core and in total capital.

Be the first to comment on "Tobin tax to have a 10% impact on Spanish equity trading volume (ACF)"