As UBS strategists comment on a report:

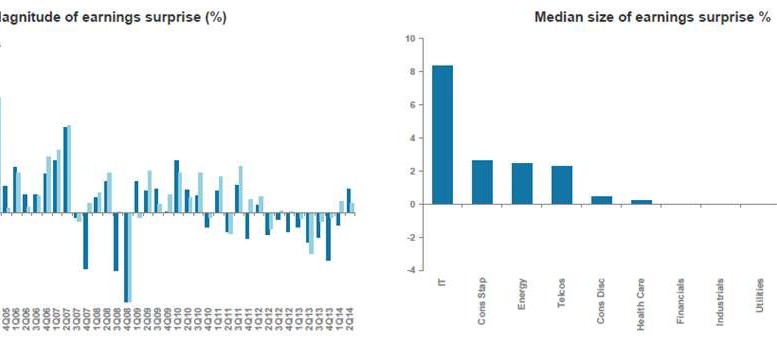

We are now at the halfway point of the European reporting season – 253 companies of the 530 we track have reported. Earnings are the key battle ground for both the Bulls and Bears as we’ve already had the P/E rerating to 13.9x – in line with long run averages. We have had 40 months in a row of downgrades – the longest period of downgrades on record.

But there are tentative signs of this coming to an end. FX is the key theme for many companies: the trade-weighted Euro was up 5% YoY in Q2, but by Q3 this headwind fades.

Sectors: looking at just the EPS compared to consensus, some of the staples, utilities and banks have beaten, whilst healthcare equipment, commercial services and autos have been weaker.

According to Morgan Stanley experts:

31% of companies have published better than expected while 30% have done worse. The calculation is apparently in line but if we focus on the results of mid- and large capitalization companies, the positive surprise is much higher, 6% more positive than negative surprises, the best data from 1Q’12.

In Spain, with almost all the results of IBEX 35 companies published, according to Banca March analysts, “the balance is satisfactory: net profit at an aggregate level increased by 10.6%, while the decline in revenue moderated up to 2.9%”.

Be the first to comment on "UBS: Q2 European earnings – 40 months of downgrades…"