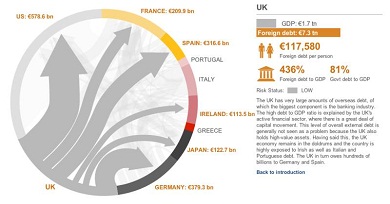

After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”.

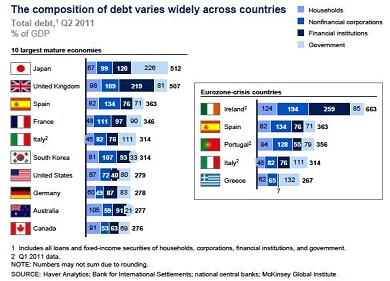

According to the BBC, each citizen of the United Kingdom has €117580 of foreign debt. 436% (BBC data) of a total of 507% GDP total debt (see below) is in foreign hands.

But the BBC states: “This level of overall external debt is generally not seen as a problem because the UK also holds high-value assets.”

Aha, I understand, there is no problem with having 436% of GDP in foreign debt, namely because the UK holds high-value assets. Some of these ”high-value assets” are the following:

9 bn € Greek debt (according to BBC high risk)

104 bn € Irish debt (according to BBC high risk)

19 bn € of Portuguese debt (high risk)

55 bn € Italian debt (high risk)

75 bn € Spanish debt (medium risk)

227 bn € French debt (medium risk)

Hence a total of 489 bn of euros, we understand, “high-value assets” using the same BBC interactive graph.

France, however holds:

41 bn € Greek debt

24 bn Irish debt

19 bn Portuguese debt

309 bn Italian debt

112 bn Spanish debt

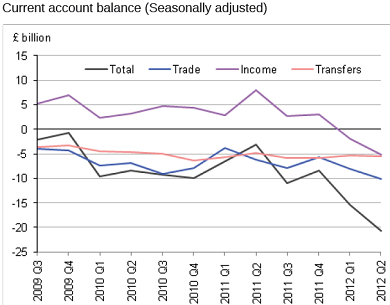

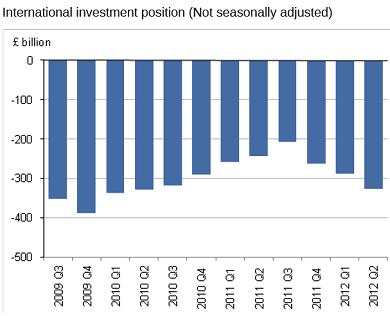

A total of 505 bn of euros of assets with medium and high risk. On the other side we see a weakening of the already negative current account and a weakening negative net international investment position (NIIP).

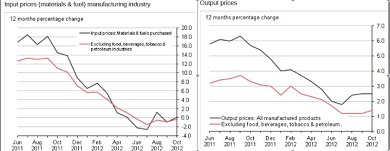

Apart from upcoming triple dip recession, we see inflationary pressures in the difference between the producer price indices for input and output. Input price changes have come down to 0, but output prices have risen by 2.6%. This leads to continuing wage inflation, which, as opposed to countries like China, Germany or Switzerland, is not reflected in improving trade balances or current accounts. For us it is a clear sign of lack of competitiveness.

This one thing seems to be clear for us: whoever downgrades France, must do the same to the United Kingdom, as well.

But we know that Moody’s have one of their main offices in London, mostly British and American share holders. Apart from Standard and Poors’ highly criticized US downgrade in August 2011, the leading three rating agencies seem to be very myopic with regards to the United Kingdom and the United States. Would they saw through the branch on which they were sitting?

They probably do not want to have the same fate like Egan Jones that, after its downgrade of the United States, faced legal action from the SEC for a years’ old action.

Be the first to comment on "UK, ruling the wAAAves"