Yiannis Mouzakis via Macropolis | This time last year, Alexis Tsipras was in the awkward position of having missed his main objectives and found himself at odds with Greece’s creditors over his decision to hand out a 13th pension.

The conflicting interests of key stakeholders in Greece’s programme did not converge and the last Eurogroup of 2016 did not lead to the conclusion of the second review. Instead, it dragged on until June this year. Most critically, the main goal of being included in the European Central Bank’s QE programme was missed as the ECB required assurances about the country’s long-term debt sustainability and Germany was not willing to discuss even the medium-term debt relief measures, which were eventually pushed back to the end of the programme in 2018.

The months that followed were ridden with uncertainty and the economy slowed down. To seal a deal at last June’s Eurogroup, Tsipras agreed to additional fiscal measures worth 2 percent of GDP in the form of pension cuts and tax hikes for 2019 and 2020, mostly to appease the fiscal concerns of the International Monetary Fund.

Fast forward one year, and Tsipras has secured a staff-level agreement (SLA) on the third review and the big prize of exiting the memorandum era, which he promised Greeks in 2014 when he campaigned for their vote, is now in sight.

For Tsipras, it is probably the last opportunity to form a narrative that will preserve, or even restore some of his political capital and allow him to remain a key player in Greek politics. Greece has returned to growth. It has also managed to tap the markets twice, even in the form of bond swaps, with more issues to follow in the next months. The SYRIZA leader will claim that he was the one that managed to take Greece out of the MOUs, albeit with a delay.

However, can Greece’s prime minister really claim victory or feel vindicated about his strategy? Was the path that Tsipras mapped out the necessary route for Greece to reach the point of graduating from the ESM programme? What was the actual price for the tumultuous first half of 2015 that sealed the country’s fate?

What follows is a look at key aspects that were impacted by Tsipras’s negotiations, and the cost of each.

Economy

In 2014, Greece managed to record its first year of real growth since 2007. The economy grew by 0.7 percent that year. In Q3, it expanded by 1.3 percent compared to the previous year, which was one of the highest growth rates in the eurozone.

Greece was not out of the woods by any means. The budget was not performing according to targets and it ended up missing the programme’s primary surplus goal by a wide margin. The fifth review was demanding: the troika was expecting hard-to-swallow measures from Prime Minister Antonis Samaras and was offering little on the debt front.

Fiscally, the country had to agree to a path that would lead it to a primary surplus of 4.5 percent of GDP by 2016. Lacking the necessary votes in Parliament to elect a new President of the Republic, Samaras knew he was on borrowed time before national elections would be called.

Despite this complicated mix, if one leaves the political risk aside, Greece was expected to carry on growing in 2015 and 2016 even by the more conservative organisations. The Organisation for Economic Cooperation and Development, for instance, has been consistently the most reserved in its forecasts for Greece throughout the crisis.

In its economic outlook in the summer of 2014, it estimated that the economy would grow by 2.3 percent in 2015 and a further 3.3 percent in 2016.

The IMF is often inaccurate in its projections but cannot be accused of being overly optimistic with its estimates after 2012. In the last completed review document it put together in the summer of 2014, it expected Greece to grow by 2.9 percent in 2015 and 3.7 percent in 2016.

Both organisations saw private consumption and investments pick up due to the low base effect and having been suppressed from seven years of deep crisis at the time.

Going by the counterfactual, as Greece would need to deliver a big volume of fiscal consolidation to meet the 4.5 percent target, and by the experience we now have that investments have not been as responsive as initially hoped, it can be argued that both of those estimates required everything to work like clockwork and were probably too optimistic.

At the same time, Greece this year will manage to deliver growth of 1.6 percent, expected to accelerate to 2.5 percent in 2018, which shows that giving the economy a clean run without uncertain factors allows it to deliver growth despite the fiscal effort.

The argument that Greece would be in a position to deliver decent growth rates from 2015 onwards is supported by the fact that while Tsipras’s calamitous negotiating strategy was unfolding, the Greek economy did not tank in the first half of 2015 and it was only after the imposition of capital controls at the end of June 2015 to stave off an intense bank run that the economy contracted. Even then, it only shrank by 2.4 percent compared to a year earlier, mostly due to the fact that Greeks had anticipated developments and cash in circulation in the economy had reached an all-time high of 50.5 billion euros.

We estimate that in the 2015–2017 period Greece could have delivered average annual growth rates above 1.5 percent, not factoring in the potential inclusion in QE had Greece’s place in the eurozone not been put at risk during Tsipras’s first months in power.

The opportunity cost for the economy because of these developments in 2015 comes to approximately 10 billion euros.

Banks

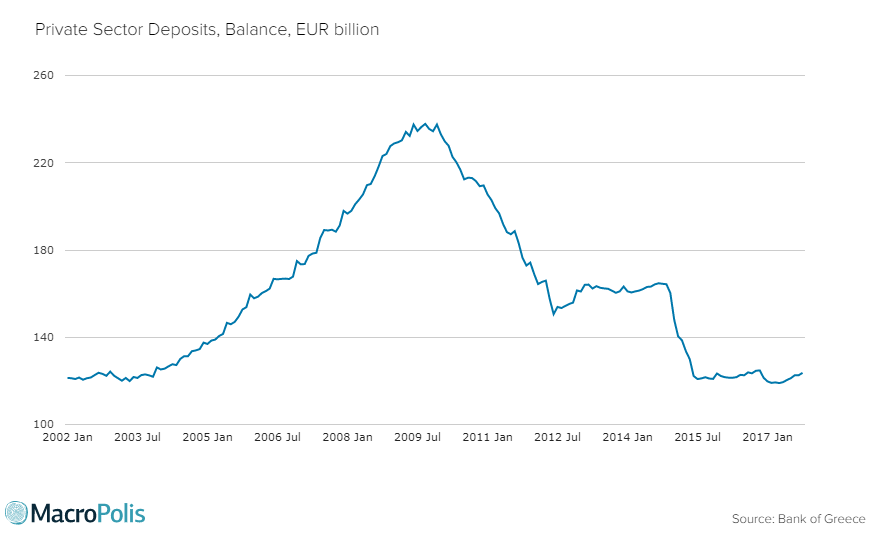

The Greek banks have been the barometer of Greece’s instability since the start of the crisis. When the crisis started, the private sector deposit base stood at 237.5 billion euros. The first wave of decline stopped in June 2012, when deposits landed at 150.6 billion. Following a modest recovery after Samaras formed a three-party coalition, deposits climbed back to roughly 164 billion in November 2014. At that point, it became apparent that Tsipras would trigger new elections by refusing to agree with the government’s proposal for a candidate in the presidential ballot scheduled for March 2015.

What followed was the sharpest drop in private sector deposits seen during the crisis. Deposits plummeted to 122.2 billion by June as Greeks were hoarding cash or moving it abroad in fear of a euro exit or in anticipation of capital controls after events in Cyprus.

At the start of the crisis, the banking sector lost 87 billion euros of deposits in a 30-month period. In Tsipras’s tenure during the first half of 2015, the system lost roughly half that amount.

This puts Tsipras’s cost with regard to the banks deposit base at 42 billion euros.

Banks valuations

The Greek state, via the Hellenic Financial Stability Fund (HFSF), has contributed a total of 30.43 billion euros for the recapitalisation of the four core Greek banks. Of this, 25 billion was injected in the first round and 5.43 billion in the third round of the recap process. The latter is split between 1.36 billion in the form of shares and 4.07 billion in CoCos for two banks.

This is by far the largest financial commitment the Greek state has made in its history, representing close to 18 percent of the Greek economy. If you add the amounts that were required for the resolutions of banks, the total allocation reaches close to 44 billion euros, or a quarter of Greece’s economy.

At the end of 2013, the value of the holdings of HFSF in the Greek banks was worth roughly 22.6 billion euros.

In 2014, the banking index tumbled by 46.5 percent, largely reflecting a nosedive of 33.7 percent in the last quarter of that year. The market started pricing in the uncertainty as Samaras and his government started rolling back reforms following defeats in local and European Parliament elections, failed to close the programme’s fifth review and national elections at the beginning of 2015 seemed inevitable.

The valuation of HFSF’s bank portfolio by the end of 2014 had nearly halved from a year earlier to just 11.6 billion.

If the end of 2014 was bad, the first year of Tsipras in power for banks valuations was catastrophic. In the first five months of the Tsipras administration, bank shares fell by another 31.5 percent on the back of the drawn-out and confrontational negotiations with creditors, deposit flight and further deterioration of the loan portfolio.

Bank shares slumped by another 91 percent by the end of the year. The share collapse in the second half of the year was marked by two key developments.

The banking index plummeted by 58 percent in the first five sessions after the five-week bank holiday that followed the imposition of capital controls in the wake of uncertainty about economic developments and rumours of massive additional capital needs.

Moreover, Greek bank shares plunged by 77.2 percent in the course of November 2015, when the share capital increases were announced and conducted, with deep discounts in the offer prices of the book-building processes.

Those discounts ranged from 34.4 percent for Alpha to 52.4 percent for Eurobank, up to 80 percent for Piraeus and a massive 93.8 percent for NBG. They were applied to the already low prices that resulted following a 74 percent nosedive of bank stock prices in the three-month period after the imposition of capital controls and before stress test results were announced by the Single Supervisory Mechanism on October 31.

Overall, the value of the Greek banking index was essentially wiped out during 2015, when it nosedived by 93.9 percent. This caused massive valuation losses for all bank shareholders, including the HFSF.

In 2015 alone, the cost of Tsipras’s management of the negotiations and subsequent recaps stands at 9 billion euros. If his share of responsibility for the events at the end of 2014 is also attributed, the bill rises to 12 billion euros.

State arrears

One of the immediate results of Tsipras’s choice to take the negotiations to the wire was the absence of disbursements from Greece’s official creditors, which led to a significant funding and liquidity squeeze for his government.

The Finance Ministry had to postpone or delay a large part of non-payroll costs from March 2015 to cover its imminent external funding needs.

State arrears to the private sector had peaked at 8.8 billion in 2012 but assisted by programme funding, they dropped back to 3 billion euros at the end of 2014.

By July 2015, arrears had reached 4.96 billion euros, a rise of 64 percent in just seven months. We attribute this effect fully to the acrimonious negotiations with the creditors, at a cost of nearly 2 billion euros.

Repos

The Greek state had started using repos of the cash reserves from various state bodies in 2014 as a form of cash management to meet short-term funding needs. They were usually short-term transactions of 90 days or less that were either wound up or rolled over.

By the end of 2014, the stock of repos stood at 8.6 billion euros.

As a result of the liquidity squeeze that the SYRIZA-led government experienced in the first half of 2015, it resorted to using state bodies’ cash reserves not only as a short-term cash management solution but also as the necessary means to meet external obligations.

The stock of repos at the end of July 2015 had nearly doubled to 16.9 billion euros. The indication that Tsipras has not been able to return these funds to the state bodies is that the stock of repos in October of this year, almost 2.5 years since the peak, still stands at 16.5 billion euros.

The cost of the first half of 2015 on state cash comes to 8 billion euros.

The final bill

Tsipras has often had to contend with claims that he cost Greece 100 billion euros, which is the sum that some attach to the tenure of Yanis Varoufakis at the Finance Ministry. But this accusation is not justified. Even if the programme reaches its full capacity, which now seems unlikely as it is estimated there will be around 20 billion euros to spare, much of the financing was mostly used to meet debt obligations and Greece would have had to find the means to refinance these obligations anyway. Since it is locked out of the international markets, this financing could only come from the European Stability Mechanism.

Greece’s debt since the first quarter of 2015 has grown by 17 billion and not by 100.

However, the collateral damage of the first six months of 2015, which exceeds 70 billion euros, cannot be disputed and given the size and multitude of the costs, the logical question is whether it was all worth it.

Tsipras has very little to show in terms of substance for his combative stance. The framework remained the same as before, he did not get anything on debt relief and the revised programme targets were something that could have been achieved without testing his relationship with the eurozone. If anything, the complete collapse of trust from the other side of the table required him to make heavier commitments, like the asset development fund. Also, with regards to the fiscal effort, what was saved in terms of the targets had to be compensated by more heavy lifting due to the decline in economic activity.

Greece has been let down on numerous occasions by its politicians and Tsipras has often criticised opposition parties for their role that led to the crisis in 2009 and its management subsequently.

However, he must look back at those six months of 2015 and wonder what he was thinking. Even if his claim that he was acting with good and pure intentions is true, when you are in charge, you are measured against the outcome. This is why he is destined to find himself in the same group of politicians that he built his political career criticising: those that caused Greece severe damage.