Foreign banks find it difficult to reach the first-rate German clientele. However, it is an unavoidable challenge because Germany is a country full of multimillionaires, where 18,000 ultra high net worth individuals (UHNW) live. Thus, this is the only European country (with four of its main cities: Munich, Düsseldorg, Hamburg and Frankfurt) included in the list of the ten first UHNW cities.

One of the most peculiar features of the rich Germans is their loyalty to their banking institution, with which they remain linked for around 17 years. Nonetheless, foreign banks have problems to reach them, because most of the Germans invest their money in deposits, saving bonds and installment accounts, avoiding equity and market investments.

QUESTION.- In Germany, the risk of “Euroscepticism” is on the rise and the government’s policies doesn’t help much. Mr. Müller, Eurosceptics wonder what did the euro provide Germany, what would you tell them?

ANSWER.- In recent years, we have seen that the common currency involves political and economic costs, which must be assumed by society. Nonetheless, the problem wasn’t the euro by itself, but its configuration and the poor compliance of the European regulations. During a period of time, there were doubts about the survival of the euro. However, even though the German State has benefited from liquidity and the low refinancing costs of its debt, the advantages arisen from the euro went mostly unperceived in times of crisis. As the crisis begins to fade, this perception will soon change and the German economy will benefit from the advantages of the common currency.

Q.- You have emphasised the idea that Germany has a responsibility towards the euro, because the country has benefited a lot from the common currency. Which are the criteria of limited responsibility that you demand?

A.- Without any doubt, Germany has a special responsibility in Europe, both for historical reasons as well as for its economic strength, which means that it is our duty to help our European neighbours. And we should do it in the form of an aid conditioned and linked to the commitment to implementing the necessary reforms. Such conditioned aid is in the interest of all of us, and it can serve to successfully fight against the causes of the crisis.

Q.- What does the German private banking say about the European Banking Union and the common deposit guarantee fund?

A.- The European Banking Union is an important project which allow the estabilization of our system for the future, making it less susceptible to the crisis. However, it will take a long time to reach a common European insurance deposit. But it is ok like this, because before talking about a single deposit guarantee fund (SDGF), we will have to be clear about how the single supervisor mechanism (SSM) and the single resolution mechanism (SRM) work. And it isn’t clear yet how both should function.

Q.- Germany projects an image quite different from reality: until recently, its debt had always been higher than Spain’s. However, German media only talk about the Spanish large debt.

A.- It’s true: Spain’s sovereign debt has been lower than the German for quite a long time. It is precisely that good public finance situation before the crisis which prevented from seeing the huge imbalance in the current account balance. Spain got heavily indebted abroad in order to finance its internal boom. If we analyse what happened in the property market, it is obvious that the capital wasn’t always invested in productive sectors. Such mistake is now being corrected, which involves a considerable burden for Spain. Now the Spanish sovereign debt and the private sector’s debt exceed the German’s. Be that as it may, Spain has undertook wide and brave reforms, which we consider appropriate for overcoming the crisis.

Q.- Who will pay for the debts at the end?

A.- What we are living right now is similar to a struggle for the distribution of resources. It is yet to be answered the question about who will pay for the largest part so as to reduce the states’ huge debt at a reasonable and sustainable price. We don’t know yet who will pay for the damages, but something is clear: probably all of us will pay to a greater or lesser degree in the form of higher taxes, less social benefits, negative interest rates or a longer working life.

Q.- Let’s talk about the free fall in interest rates. German media criticise the negative effects of the ECB’s monetary policy on the German savers and the positive effects on the shareholders. True or false?

A.- True. It is a certain fact that investors in nominal assets (cash and money in bank accounts) are caught in the trap of the real interest rate. Discounting inflation, profitability on the capital invested is usually negative. Thus, private investors, foundations, insurance companies, pension funds and savers in general helps to pay the economic imbalances’ costs. In order to avoid such trap, we should reduce the assets invested in fixed income and then invest in profitable assets or businesses. Nowadays, the stock market really offers an alternative to invest diversifying one’s savings.

Q.- In the European debt crisis, the ECB has become an important political power, and its president Mario Draghi in the “champion knight” of the monetary union. What does the German private banking think about the ECB’s work?

A.- Throughout the crisis, the ECB has surprised the markets several times with its verbal and monetary interventions, and it has made clear that he will do anything so as to guarantee the financial stability in the euro zone. Such measures were decisive in order to appease the general mood, so they have been correct so far. Nonetheless, their price is the current situation, in which investors in nominal assets are barely able to retain their capital because they only generate negative profitability.

Q.- One of the main goals for the ECB is weakening the euro’s exchange rate. Is it good for Europe?

A.- First, let me tell you something about the course of the euro. The ECB’s monetary policy is not excessively expansive when compared to other big central banks. That’s why we can’t criticise it for intervening in the exchange rate. Regarding what is good for Europe, it is obvious that having a stable currency is something good. And that’s what we have had, despite the crisis of the sovereign debt of the last years. There may be a negative deposit rate, which would involve the ECB venturing into uncharted territory. I think the central bank will think it twice before going there, especially if we take into account experiences such as the Danish one, which shows how banks transferred the negative interest rate to their clients so as to unblock credit, but they achieved just the opposite: clients had to pay higher interest rates for their credits.

Q.- Banks are receiving a lot of credit. What will happen if companies and consumers don’t react as ECB’s authorities and Mr. Draghi expect?

A.- I’m optimistic. Opinion polls point that companies and consumers are also more optimistic than a year ago. However, the recovery is so slow because many banks from the euro zone have to adjust their balances: that’s why credit does not flow to the economy. Many banks prefer to have reserves instead of providing credit. Nonetheless, this is also improving; in the banking system we see how such surplus reserves are diminishing. So the situation is normalising.

Q.- The German Dax continues unstoppable thanks to the economy and the attractive of fixed income versus other investment modalities. What will happen now?

A.- Equity markets are now benefiting from an exceptional situation. On the one hand, the economy is recovering; and on the other hand, the economic take-off is not stable enough so that central banks may stop acting by means of monetary policies. However, in 2014 we will go back to normality. There may be potholes in that intermediate stage, because equity markets will have to face the withdrawal of monetary stimuli. Be that as it may, forecast for equity are positive because companies are making money.

Q.- Inflation? Deflation? What will come?

A.- The scarce increase in inflation in the euro zone is the product of several elements. We have to take into account the evolution of prices in energy and food, but also the different governmental policies of each state. However, we don’t see any deflationist risk; on the contrary: we consider the scarce increase in inflation as a relief for many families, because it encourages the private consumption. I think that, from now on, inflation in the euro zone won’t go any lower. It is true we see some deflationist movements in some European countries, but that doesn’t mean there is a generalised deflation (understood as a “diabolic” fall, generalised and extended, in the price levels of a wide range of goods and services). Furthermore, we can see an economic upturn.

Q.- Do you also see an economic upturn in Spain?

A.- For me, Spain is one of the countries which is facing its problems with more determination. Of course, it hasn’t been and it isn’t easy for Spaniards, but I believe it is certainly no in vain. Even though the private sector’s debt is still too high, and many banks and cajas are still in trouble, they are all compensating the imbalances thanks to the foreign trade. Spain’s competitiveness is also improving, and I think that the economic growth of the third semester in 2013 was not something short-lived.

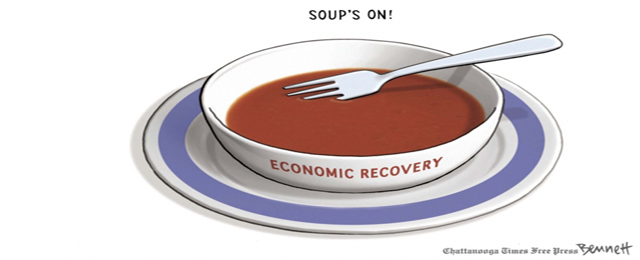

Q.- How do you see the economic recovery in the euro zone?

A.- I am convinced that the economic recovery is already underway and that the euro zone will grow. It’s true it has been a weak upturn, but we will continue to grow from now on.

Be the first to comment on "“Recovery in the euro zone is underway, but we still don’t know who will pay the debts”"