The economic slowdown in Europe is being felt in the third quarter companies’ results, which are leaving the region stock markets in red. Losses are ranging from 4% to 12%, making the European results season show the worst trend in four years. It is interesting to review the main points that analysts at Morgan Stanley make.

1. This is the worst quarter since Q414:

a) 33% of companies have beaten expectations while 35% have disappointed them, a net 2% disappointed.

b) The weighted PER remains at -2.5% below expectations, the worst quarterly figure since Q216.

c) The sectors which have most disappointed: Discretional consumption and industry.

d) The sectors which surprised positively: Energy and technology.

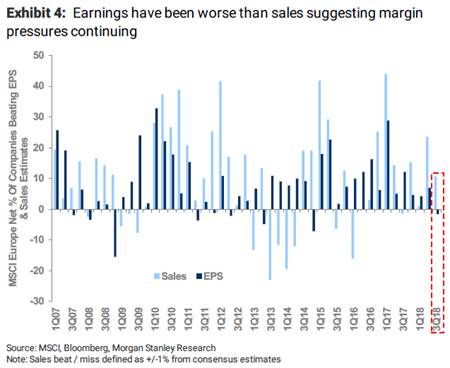

2. The key is in the margins:

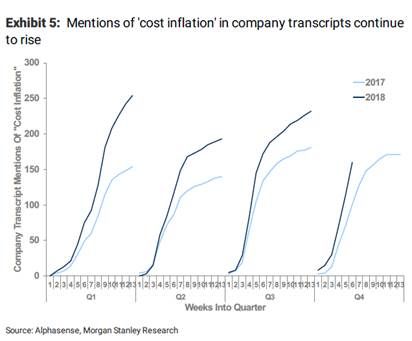

a) As in Q218, the companies beat expectations on sales but there has been a significant acceleration in costs.

b) Numerous companies have cited cost inflation as the main factor in disappointing results.

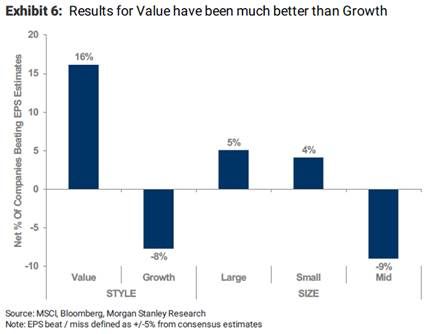

3. Value easily beats growth.

4. The revisions of profits are at two and a half year lows, possibly they will stabilise from now on.

On the other side of the Atlantic, the 80% of firms that have published their results beat the market with an average earning per share growth over 25% against the European around 7%.