Yes, inflation is a global phenomenon, and inflation moving higher elsewhere will help Euro area inflation. According to BoAML, “while the global backdrop will be helping, it will not move the needle enough to sustain inflation beyond the mid-year hump.” Analysts think that a gradual improvement in the global output gap will generate a cumulative increase of 5bps in Euro area core inflation.

Will global reflation help?

It will, but not a great deal. Experts at BoAML argue that even global forces (beyond the hump created by oil prices) are likely to play only a moderate role in the behaviour of Euro area inflation.

We have been expecting inflation to fade sharply in the second half of the year and think the strong reflation theme is unlikely to have more legs than that in the Euro area. For this to be wrong either the currency needs to weaken significantly or oil prices need to move much higher. Alternatively, one could argue that the indirect and second- round effects from rising oil prices could do the trick, but we believe this won’t move the needle enough.

A refined argument from clients is that inflation is a global phenomenon, and inflation moving higher elsewhere will help keep inflation higher past the hump generated by the direct impact of oil. Perhaps, but we think idiosyncratic factors still play a significant dampening role and, more importantly, the global backdrop will be helping, but it will not move the needle enough.

Yes, inflation is moving higher everywhere

A modest pick-up in global core inflation is underway, and analysts are particularly bullish on Japan, the US and some key emerging market economies in this respect.

This becomes even more evident if we go back to our old methodology of calculating the underlying global trend in inflation. To be more precise,they extract a common factor from global inflation trends in the OECD countries, for which there is a long enough time series to do so properly. This common factor, or global trend, has moved significantly higher in recent months (Chart 8). Note that the chart (this one and the ones that follow) is expressed in normalised terms. Global inflation has improved 0.3 standard deviations in the last few months, a sizeable move.

And yes, inflation is a global phenomenon

This is very relevant. This global trend explains much of the variation in individual countries in the sample and has mean reverting properties (it pulls individual countries’ inflation towards it in the future). Hence this highlights inflation moving higher in the near future. And correlations are significant. As reported by BoAML:

The global trend explains more than 90% of the variation in Euro area inflation during the past 50 years.

But idiosyncratic factors also matter and explain the weakness in Euro area inflation, which is well below what the global trend would justify (Chart 9). These factors have caused Euro area inflation to underperform since late 2013. And while they are slightly smaller now, they still play a significant role. These idiosyncratic factors – a sizeable (still) output gap together with risks of second-round effects and not perfectly anchored inflation expectations – are not helping the performance of Euro area inflation relative to the global trend.

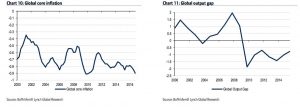

But global core inflation is still subdued

The obvious question is how much of the move in the global inflation trend is driven by oil prices. The global trend in core can allow us to better gauge where inflation will be one year down the line. Hence, we redo the exercise using core inflation, for which the sample is much shorter (Chart 10). Note that global core inflation still explains a large part of individual countries’ core inflation.

The picture is slightly different from that using total inflation. Once the most volatile components of inflation are stripped out, inflation has been moving sideways for the past few months, and even slightly weakened very recently. In other words, analysts at BoAML explain:

The global trend in core inflation suggests a much more cautious approach to the whole reflation theme. Indeed, would argue below that it is unrealistic to expect more than a modest pick-up in global core inflation.

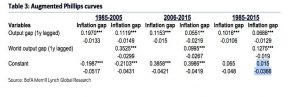

Don’t forget slack

Why has global core inflation moved sideways in the last few months? The answer, once again, has to do with the persistence of slack at a global level. To look at this, they first apply the same methodology to our series of output gaps; that is, we extract thecommon factor (Chart 11). The global output gap has been improving consistently over the past two years. And recall that the correlation between the two synthetic measures of global inflation and the global output gap is very tight, as large as in traditional individual countries’ analysis (about 70%). There is such a thing as a global Phillips Curve.

The good news is that the global output gap is about to close, which should contribute to moderate inflationary pressures in the future. If it follows the recent trend, that global output gap should be pretty much at 0 by the end of 2017, and it should have improved a cumulative half standard deviation by the end of 2018. How much is that worth in terms of inflation?

Friends are helping, with limits

An exercise analysts did before can help answer that question.

Recall that we followed the methodology developed by Borio at al. (2007)1 to show that inflation is a global phenomenon and that inflation in a country depends not only on the country’s output gap but also on the global one. Using our results back then (Table 3), an improvement of half a standard deviation in the global output gap until the end of 2018 will generate a cumulative improvement of 5bps in core inflation by then. The global backdrop is therefore helping, but it will not move the needle enough.