Another week left behind us and another wave of alarms about euro zone banks being de facto rescued by the European Central Bank’s long-term liquidity operations or expecting European Financial Stability Fund capital injections. Sí, Spain and its financial sector were back in the headlines, somehow accompanied by Portugal and Italy in a variety of doom-and-gloom combinations, with what some in Madrid see as self-fulfilling forecasts.

At The Corner we say shooting the messenger would mostly be wrong and often boring, even if there was little of original matter in most of the reports and some economists were highly sceptical about the data used (what is the actual figure for Spain’s gross external debt per GDP? 363% or rather 215.8%? And why not use the net sum after sector consolidation, which is 91.6% of GDP?)

That is why IESE Finance professor Pablo Fernández’ approach is worth checking: he shoots the message itself.

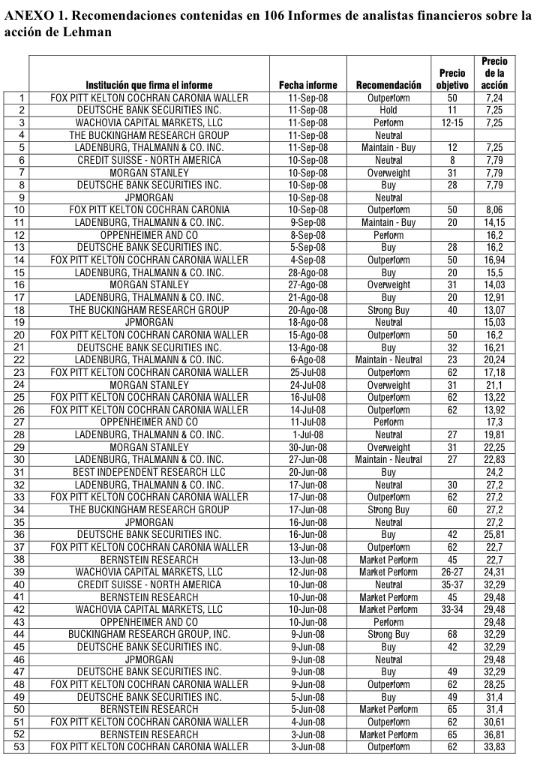

Of the recommendations of 106 reports published by Lehman analysts working at different financial institutions between January 3, 2008 and September 11, 2008: 65% recommended buying shares of Lehman (such as Morgan Stanley on September 10, 2008), one (May 22) recommended selling the shares, and the rest (including Deutsche Bank, Oppenheimer, Credit Suisse and JP Morgan Landenburg) recommended keeping the shares.

Even in September 2008, the 14 reports analysed, 7 recommended buy, 2 keep or buy, and 5 recommended keeping. In his paper, professor Fernandez says that

“To maintain that the failure of Lehman was expected before September 2008, one must have become a millionaire as a result of bankruptcy. If anyone would have predicted the bankruptcy of Lehman, it would have made huge personal profits by betting on the collapse of Lehman,”

which might not sound as a classic scholar argument, but one conclusion seems unavoidable: while all eyes are turned to the same subject, there is a wide grey area where the actual impending defaults lurk as they please.

Be the first to comment on "An impending euro catastrophe? Fear the ones you hear nothing about"