The Bank of England increased last week its main rate by 25 basis points to 0.5%. According to Philippe Waechter, chief economist at Natixis AM there are two reasons in the UK economy to explain this movement: a low productivity and a surge of inflation.

The British economy has changed and its productivity trend is much lower now than before the crisis. This means that the risk of overheating is associated with a lower growth rate than before the crisis. Therefore the BoE has to move more rapidly than in the past, the equilibrium BoE interest rate is lower.

Nevertheless, if Brexit is a source of weakness according to the BoE it is not a source of rupture (this can be discussed). The economic scenario of the BoE is quite optimistic as it suggests that productivity growth could improve converging to the momentum seen in other developed countries.

Every developed country has witnessed a lower productivity trend after 2009. But the UK has had a productivity profile weaker than every other large developed countries except Italy since 2011. A convergence would help to balance the growth process that would depend less on employment and more on productivity. The graph below shows a widening gap between GDP growth and productivity growth, the area between the two curves is employment growth. We see the difference with the pre-crisis period.

This convergence may allow higher wages and a stronger domestic demand. In a medium term horizon, the BoE scenario converges to a balanced growth even if there are uncertainties due to the Brexit process (The BoE mentions these uncertainties).

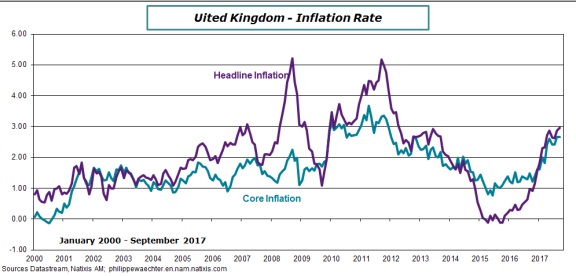

On the other hand, the inflation rate is at the top of the allowed corridor. The BoE inflation target is 2%+/-1%. It was at 3% in September and the core inflation rate at 2.65%.This reflects mainly higher import prices, notably in the food sector. The question is to know if this surge in the inflation rate is temporary or not; in other words, is it only a by-product of the referendum which mimics the drop in the currency or is it a deeper dynamics?

This acceleration is nevertheless the main reason for the BoE interest rate hike.

In the Inflation Report there is no permanent shift in the inflation rate and the recent surge has no persistence, therefore why was it necessary to change the current monetary policy stance?

If the higher inflation rate was a menace then the BoE should have acted in a more rapid and severe way. It would not be the case. The expected value of the Bank rate by the market suggests 2 hikes in the coming two years and that’s sufficient to make the inflation rate converging rapidly to 2%.

This means that for the BoE the inflation rate surge is temporary and not a menace.

The BoE arbitrage is not easy to understand in the BoE statement:

Part 1 – there is a risk associated to Brexit and more rapidly on the Brexit negotiations (the head of the CBI was, today, negative on this negotiation and said that the slow momentum to find a trade deal will damage the UK economy), international investors are reluctant to invest in the UK (the real estate prices show now a different picture than before the referendum).

The question in the scenario is the reason for the productivity convergence of the UK economy? According to the BoE scenario the British economy is spontaneously able to find the recipe to improve its behavior in the mid to long-term. Where does it come from?

Part 2 – There is a temporary surge in the inflation rate?

We could have imagined that the part 1 of the arbitrage is more important than the part 2 leading to a stable monetary policy stance.

This was not the BoE arbitrage. The risk is to send a negative signal while the economy is less dynamics than before (see the 12% drop in auto sales) and that there are no guarantees that the productivity trajectory will rapidly converge to other developed countries’ profile.

It looks like a voodoo economics where higher rates are here to persuade that the situation is stronger than expected. Can it work? Usually it doesn’t.