Not all is positive, though. Next Thursday, the Governing Council of the European Central Bank (ECB) will take steps concerning the interest rates. Barclays’ analysts do not expect a big announcement from the ECB, and many other analysts consider that it is more likely that the European institution will keep interest rates untouched. Furthermore, “the European Central Bank should stop reflecting and start outlining a solution for the alarming credit evolution in the euro zone,” experts believe.

The thing is, there is something wrong with the European credit system. Just a couple of relevant data: bank loans to the private sector have dropped by -1.4%, of which credits to businesses have shrunk by -2.8% in the euro zone. Among these, Spain’s credit to businesses fell to -5% and Italy’s plummeted to -14%.

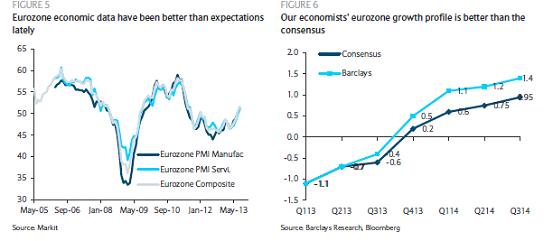

According to Barclays, “the weakness of the economy is not only due to bank lending decrease, but because of the use of capital markets instead of banks.” That is why the recovery of the European economy is still “weak” and needs more credit from the banks. Moreover, Barclays’ experts consider that “the situation may get worse with the ECB’s review of the asset quality at the EU banks in the first half of 2014.”

The lack of credit in the euro zone is a problem that has been frequently pointed out in the last months. For Professor and research Zsolt Darvas, from Corvinus University of Budapest, “the banking system soundness is the key to more SME financing.” The following chart shows the situation explained before:

In his latest report he explains “European Central Bank can foster bank recapitalisation by performing in the toughest possible way the asset quality review before it takes over the single supervisory role”. You can access the full report here.

Be the first to comment on "Mr Draghi, what are you waiting for?"