By Miguel Navascués, in Madrid | There has always been tension between the IMF and those countries under its analysis over the numbers in the fund’s economic forecasts. But this time the battle between the IMF’s Ms Lagarde and the European authorities has been set over valuations of sovereign bonds held by the banks. According to Lagarde, were the bonds in the European banks’ portfolios to be valued at their current market price…

(Quote from the FT) “Although the IMF analysis may be revised, two officials said one estimate showed that marking sovereign bonds to market would reduce European banks’ tangible common equity –the core measure of their capital base– by about €200bn ($287bn), a drop of 10-12 per cent. The impact could be increased substantially, perhaps doubled, by the knock-on effects of European banks holding assets in other banks.

“Officials say IMF staff do not claim their estimate is a comprehensive measure. But they say that the analysis strongly suggests European banks need to raise more capital, an argument recently made by Christine Lagarde, the fund’s new managing director.

“Elena Salgado, Spanish finance minister, told the Financial Times on Wednesday that the fund was mistaken in looking only at potential losses without also taking account of holdings of German Bunds, which have risen in price. ‘The IMF vision is biased,’ she said. ‘They only see the bad part of the debate.’”

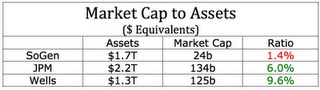

In short: European banks would be in urgent need of re-capitalisation, which would give a brutal blow to future credit inflows (non-existent so far) and would prolong the recession that we currently endure. Lagarde, to a great extent, is probably right, but since the final report must be “negotiated”, we’ll wait and see what comes out. (See, for example, the comparison chart of Sogen, JPM and Wells).

In short: European banks would be in urgent need of re-capitalisation, which would give a brutal blow to future credit inflows (non-existent so far) and would prolong the recession that we currently endure. Lagarde, to a great extent, is probably right, but since the final report must be “negotiated”, we’ll wait and see what comes out. (See, for example, the comparison chart of Sogen, JPM and Wells).

It may not be exactly a good idea to trumpet this around. But not doing so won’t bring back normality, nor credit to the real economy any sooner. In fact, European banks came into question before Lagarde uttered a word.

In its defense, the EU says that

“one euro zone official told the Financial Times that the report relied on unconsolidated data on bank exposure from the Bank for International Settlements that did not take into account mark-to-market trading losses recorded by banks between the end of 2009 and summer 2011.”

Right now everything is tightly linked. Everything is systemic. The sovereign bond crisis is the banking crisis and this is, in turn, the crisis of the euro, which in turn… In the meanwhile, no one trusts the ECB as a last resort lender. In fact, it does not want to be, it keep shying away from that role. It doesn’t want to admit, either, that some reactions to uncertainty trigger money withdrawals from the markets, and that the ECB should forget about its inflation targets in the short term. The ECB, apparently, just likes to pretend that everything is normal.

Miguel Navascués is an economist, and financial writer at Revista Consejeros.

Be the first to comment on "Ms Lagarde is right (even though the ECB would rather turn a blind eye)"