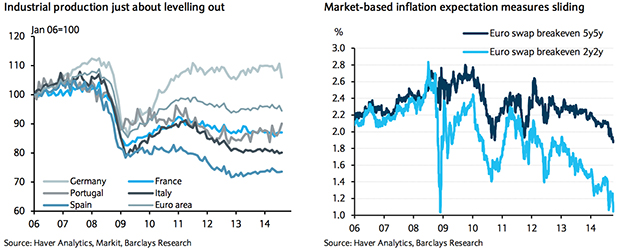

“We think that an increasingly jeopardized recovery combined with a further slide in inflation expectations across maturities has increased the probability of full-fledged QE, including government bonds (QE II). Furthermore, the likelihood that the ECB will have to go down that road earlier than Q1 2015 has also risen, in our view,” Barclays analysts commented on Monday.

Poor EZ macro data raise odds for QEII

Be the first to comment on "Poor EZ macro data raise odds for QEII"