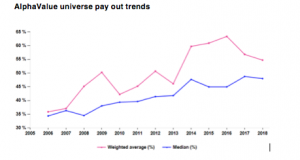

For the AlphaValue coverage (478 European stocks, c. €9.5Tn market cap), the 2017 expected pay-out ratio should be about 56% but “only” 49% on a median basis, “ergo big earners pay out more” says analysts from the house. An 11-year history of this ratio would show that the gap between average and median is going up with some sort of a maximum reached in 2016. According to Carax-Alphavalue:

The progress on the average pay-out is mechanically explained by the fact that the oil stocks have of late been paying dividends which are not funded while the Food & Beverage plays want to please their shareholders even though earnings growth is absent from the picture. Banks also have seen their average pay out rise somewhat bumpily from 35% to about 65%, thus pushing up the average figure for the full coverage universe.

The above chart does show some sort of a rising trend in pay-outs presumably as earnings have been under pressure over the last 10 years of financial crisis and then posted only subdued growth.

This means to say that corporates have striven to protect their shareholders in down times and presumably done less on the acquisition front. The balance may change if earnings are made easier by stronger GDP growth eventually leading to more courageous (herd like?) spending on external growth. Pay-outs may then contract. Shareholders tend to be paid in hope rather than hard cash during such periods.

Lower-for-longer long rates may lead to different pay-out behaviour from issuers looking forward. Cheap money means that projects can again be initiated without cutting the pay-out that much. The future will tell.

The last useful chart to give a sense of the long-term perspective is a picture of combined dividends on a reasonably consistent universe. It is intriguing to see that the 2009 cash amount was recovered only in 2015 and that a lot is at stake in 2018. A great deal hinges on the banks (see 16-02: dividends en masse)

Actual dividends paid out (AlphaValue coverage)