The European Central Bank has a mandate to fight inflation. But the target isn’t to make it completely vanish because that would push our economies on to deflation territory, so it officially declares it seeks a ‘slightly below 2%” rate–which is an odd language comparing to its peers’ much more realistic talk of maximums in the medium term.

But I digress. What is remarkable isn’t the wording but the fact that the ECB hasn’t updated even a little bit its discourse. The central bank of the Eurozone keeps celebrating its iron fist over inflation–“better than Germany did before the euro,” as former governor Jean- Claude Trichet put it–and swinging the sword against this supposedly terrifying hydra.

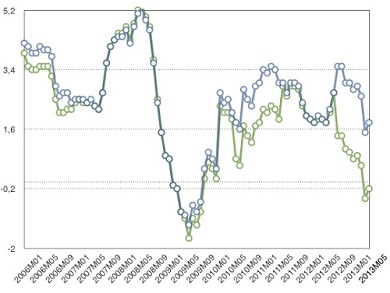

The ECB is blind, of course, and the economic cycle changes no matter what Mario Draghi believes while sitting at his desk in his Frankfurt headquarters’ office. Let’s check the inflation rate in Spain (the blue line follows Consumer Price Index figures and so does the green line but adjusting to eliminate tax rise effects).

In my humble opinion, the real inflation, the one rate that registers the tension between supply and demand, would be the green line. An increase in VAT distorts how inflation behaves because it means there has been a transfer of fiscal pressure to prices. It means some have had the ability to do that transfer, and that some have a greater degree of power over market relationships. What it doesn’t mean is that there was an excess of demand.

As the chart shows, the CPI has been inevitably falling since the crisis begun in 2008, and even more precipitously from 2012, which makes sense because it was a year of negative GDP. In fact, Spain is in deflation zone, which tells us that an economic recovery green shoot will still need some help to survive and that the ECB remains too biased towards inflation contention–a mission at which it is very bad by the look of the Spanish situation, or Greece’s, for that matter.

It seems obvious that CPI inflation in Spain is overestimated. Those who argue that inflation rates must be lower live in their own party-politics bubble. Inflation has slipped now into the negative area, and History demonstrates it isn’t a good thing.

Be the first to comment on "The boogeyman of inflation"