MADRID | Unmistakably, the reflection that the Italian economic indicators are mirroring should look very familiar to Spanish analysts. The slowdown wave is reaching core Europe too, by the way, as the Organisation for Economic Co-operation and Development reported this week: the European economies, whether using the ill-established common currency or one on their own, have been found to relate to each other in a more interconnected manner than previously suspected. But Italy’s demise appears to be the steepest, the OECD said.

Perhaps the reason isn’t that the country had until now brought forward figures that supported a more optimistic view. The Spanish alarming numbers, though, had for a while cast a comfortable shadow over what was happening in Italy’s economy. Not any more. The main Italian stock index’ performance is almost as bad as the Spanish, following strong drops and mild recoveries during the last weeks.

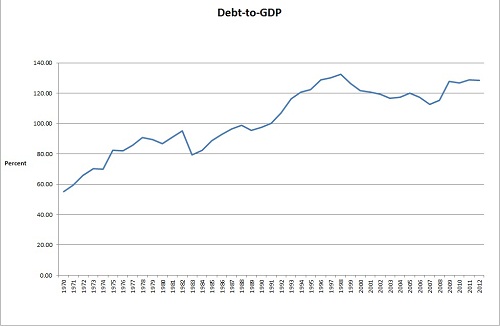

Investors are also waking up to the fact that yields on Italian bonds may be not high enough to take in the real risk of a country with a larger debt per GDP ratio than other peripherals, particularly including Spain. At the moment, Italy’s debt per GDP level is some 35 percentage points over the average in Europe of 80 percent. Rome cannot hide for much longer.

Be the first to comment on "The Italian elephant in the euro room"