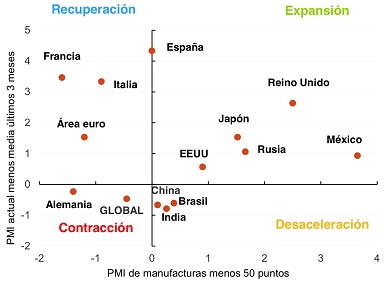

Afi analysts in Madrid warned Tuesday in a note to investors that recovery expectations for the second half of the year show increasing divergences. “While manufacturing indexes in the US, the UK and Japan seem stabilised in the expansion area with rate records of more than 50 points,” experts said, “the main emerging economies, led by China, are in deceleration mode.”

The report mentioned that exports from South Korea fell in June, and stock indexes with Asian exposure have seen prices contract.

But it also highlighted the “positive” surprise of a recovery tendency among Eurozone peripheral economies, particularly those of Italy and Spain–Portugal has been the laggard in this case–from the lows reached at the end of last year. Spain’s manufacturing PMI is now around the 50-point line for the first time since April 2011, proving that industrial activity might have left its worst day behind.

A Santander report, too, talked of “beaten expectations” in the Spanish case, entering expansion territory after 25 months, “while France and Germany remained on the 48.6-point line, below growth rates.”

Adding Italy’s figures, Afi said, growth differential between core and peripheral Eurozone countries has seen its largest reduction in the last three years.

Be the first to comment on "Tuesday’s Eurozone chart: peripherals on recovery path, Germany contracts"