Yiannis Mouzakis via Macropolis | In an interview over the weekend, the head of the European Stability Mechanism (ESM) Klaus Regling aside from the optimism on the progress of the current review hinted of one of the options that eurozone lenders might be willing to consider for the debt relief that Greece is due to receive by the end of the programme.

The current ESM programme was amply funded in 2015 to include 25 billion euros for bank recapitalisations. By the time the exercise was completed at the end of 2015, only 5 billion of programme money was required. Nine billion was put up by the private sector, resulting in a cushion of 20 billion euros of programme financing being left aside.

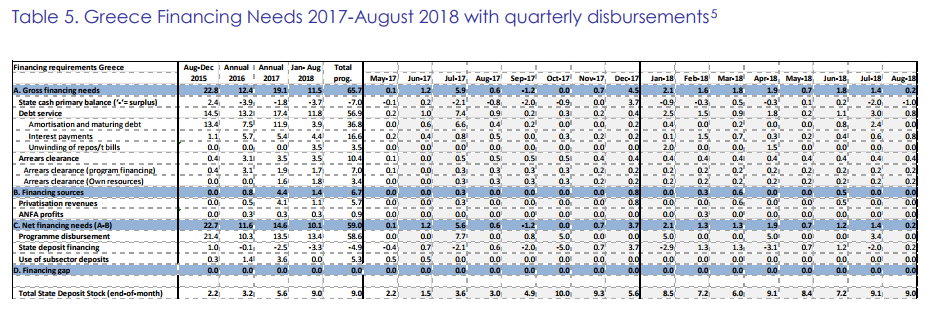

To date, the ESM has disbursed around 40 billion euros. The disbursement schedule has another 18.4 billion euros to be released until the end of the programme, which leaves close to 28 billion of unused funds available for other purposes.

Regling told Handesbladt that parts of this available financing could be used to repay more expensive creditors and further improve Greece’s debt sustainability profile.

One creditors that fits this description is the International Monetary Fund.

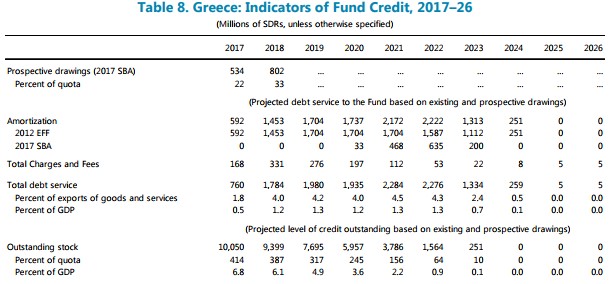

When Greece requested this summer the precautionary line from the IMF, it had outstanding obligations to the Fund of 12.06 billion euros (10.05 SDR), which represents the Extended Fund Facility (EFF) of 2012. Between this year and 2024, Greece will be repay this in full. Including total charges and fees, the servicing of the debt to the IMF exceeds 1 percent of GDP until 2013, when it drops to 0.7 percent.

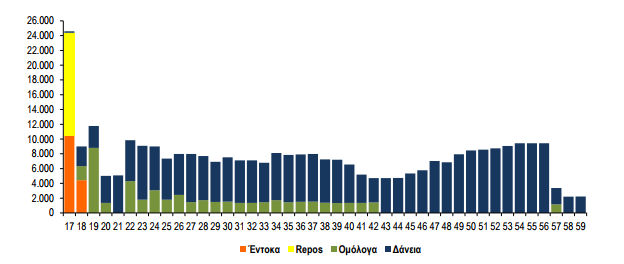

The IMF loans also represent a decent chunk of the maturities’ profile in the near-term. The nearest official creditor that comes into repayment is the GLF bilateral loans of the first programme, which are due to be repaid from 2020.

Prepaying all, or parts, of the IMF loans with ESM financing reduces the level of market access that Greece will need to pursue in the post-programme period. This would improve the chances of the rehabilitation period being a success, combined with the cash buffer that the Eurogroup agreed in the summer.

There is an additional benefit in the form of net present value as near-term obligations will be swapped with very long-term obligations since the ESM loans mature in several decades.

Greece will also be able to save a small sum in the servicing of the debt as the IMF charges around 3 percent on its loans versus ESM financing at cost and, despite the amount being small, it further reduces the need for high primary surpluses to keep the debt trajectory on the decline.

Overall, it is a good use of programme financing and a step in the right direction with regard to the effort of getting Greece back on a more normal path. It will provide the country with a better chance of standing on its own feet without official sector loans.